如何通过wish平台“税务设置”提供计算墨西哥增值税所需的 RFC 税号?

如何通过wish平台“税务设置”提供计算墨西哥增值税所需的 RFC 税号?

为了帮助wish商户遵守墨西哥政府于2019年12月出台的墨西哥税收改革法案,Wish 在商户平台上推出多种功能供商户使用。本文将向商户介绍 Wish 如何针对墨西哥税收改革法案协助收取和缴纳增值税 (VAT) 和所得税。

请注意,本文提供的信息不构成税务、法律或其他专业建议。

增值税 (VAT)

墨西哥政府出台的新税收改革法案要求 Wish 代扣商户在 Wish 平台上的销售增值税 (VAT)。增值税适用于发货地址以及收货地址(目的地)均位于墨西哥的 Wish 平台订单销售额。

重要提示:商户的墨西哥联邦注册税号(RFC 税号)将决定 Wish 从其销售额中收取增值税的方式。

自 UTC 时间2020年12月21日晚8时起,Wish 将开始向符合上述增值税纳税要求的产品的销售额收取墨西哥增值税(向用户展示的标价已包括16%的增值税)。如果您已提供有效的 RFC 税号,Wish 将根据您的账户类型执行预扣和缴纳增值税流程:

“企业”(法人)账户:wish平台会将从您相关销售中收取的全额增值税汇款给您,然后由您缴纳给墨西哥政府。

“个人”(自然人)账户:wish平台会将从您相关销售中收取的增值税额的50%汇款给您,并建议您将其缴纳给墨西哥政府。其余50%将由 Wish 直接缴纳给墨西哥政府。

如果您尚未向 Wish 提供有效的 RFC 税号,Wish 将从您的销售额中预扣全额增值税 (16%),并将其缴纳给墨西哥政府。

如何向 Wish 提供 RFC 税号?

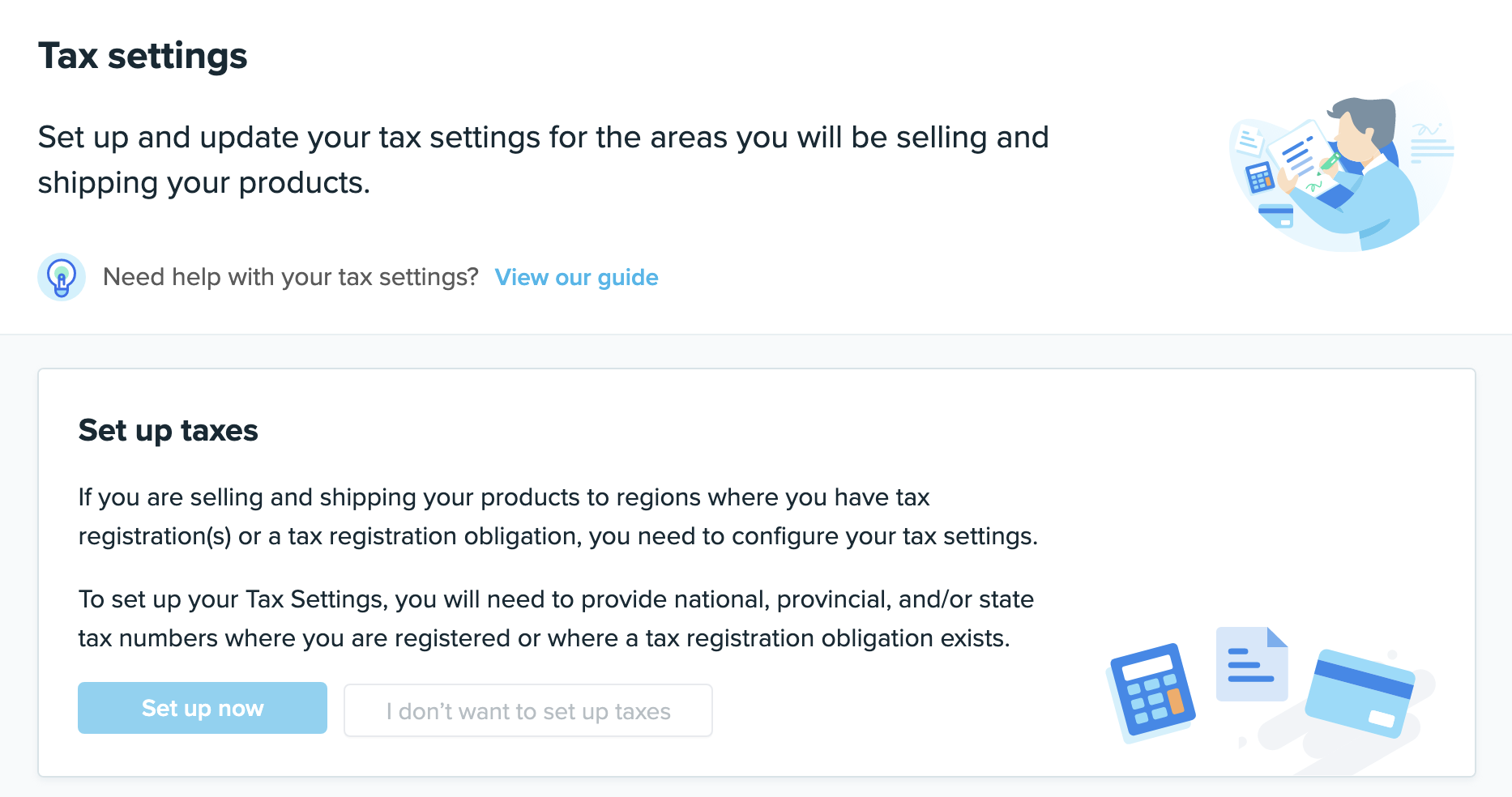

1. 在商户平台上前往“账户”>“税务设置”页面。如果您之前尚未验证您的店铺,请先点击“验证我的店铺”,验证店铺后再进行税务设置(如需了解有关如何验证店铺的更多信息,请浏览此常见问题解答)。如果您已经验证了您的店铺,请点击“立即设置”:

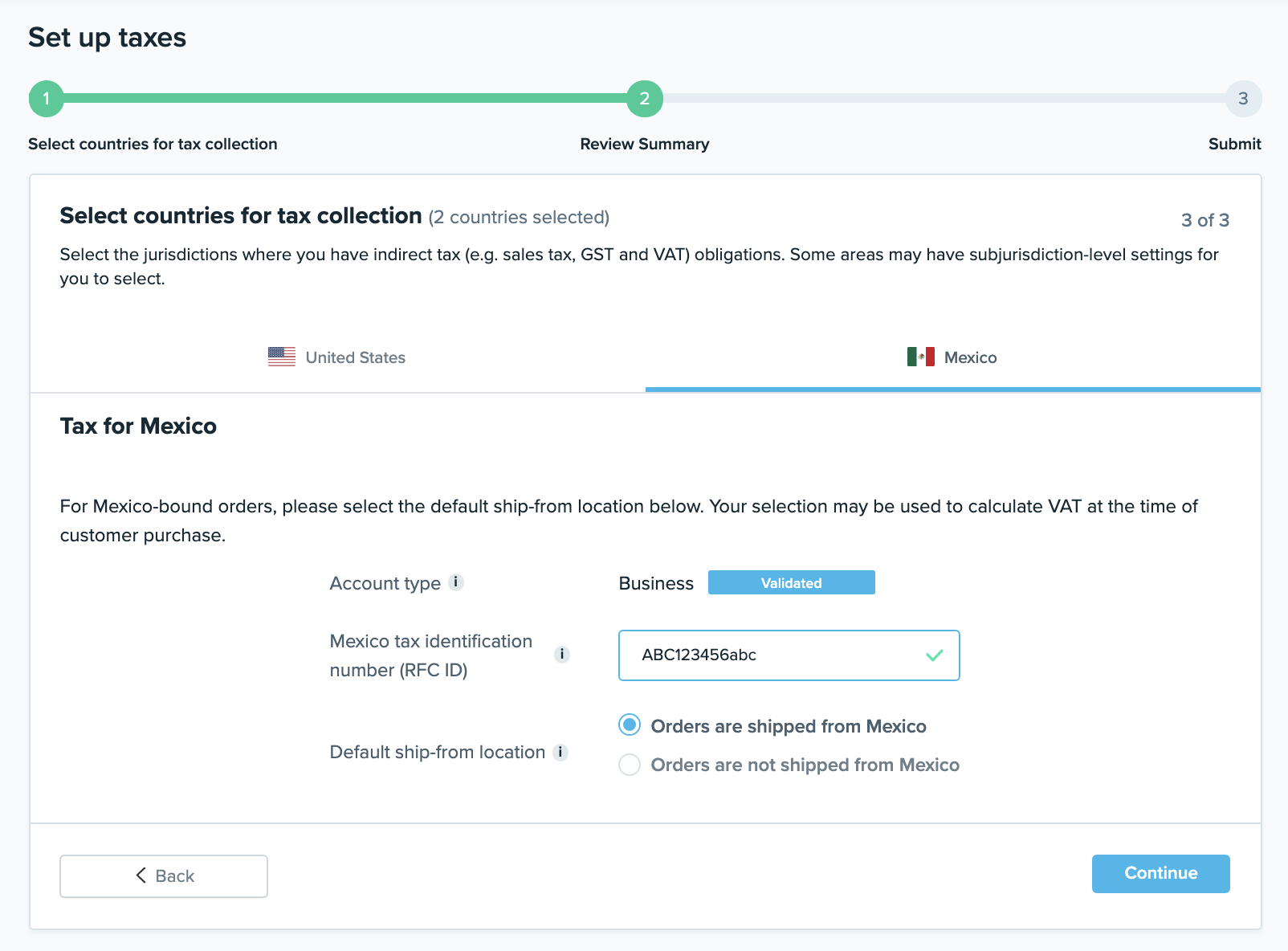

2. 接下来,选择“墨西哥”以设置墨西哥税项,然后点击“继续”:

3. 您可以在随后的页面上提供 RFC 税号:

请注意,在此页面上:

“账户类型”基于您在验证店铺时所提供的信息

关于有效的 RFC 税号:

如果您的账户类型是“个人”(自然人),则 RFC 税号长度为13个字符,并由字母和数字组成。

如果您的账户类型是“企业”(法人),则 RFC 税号长度为12个字符,并由字母和数字组成。

对于墨西哥路向订单,您可以选择默认发货地点。wish平台将基于您的选择计算用户购物时的增值税(请参阅上述计算详情)。

提供正确信息后,请点击“继续”。

4. 您可以在下一页中查看已输入的税务信息摘要。点击底部的复选框即表示您同意对所提供的全部信息的准确性负责,并负责收取以及向有关当局上报和缴纳所有税款。点击“提交”,即表示您还同意遵守“Wish 商户税务政策“:

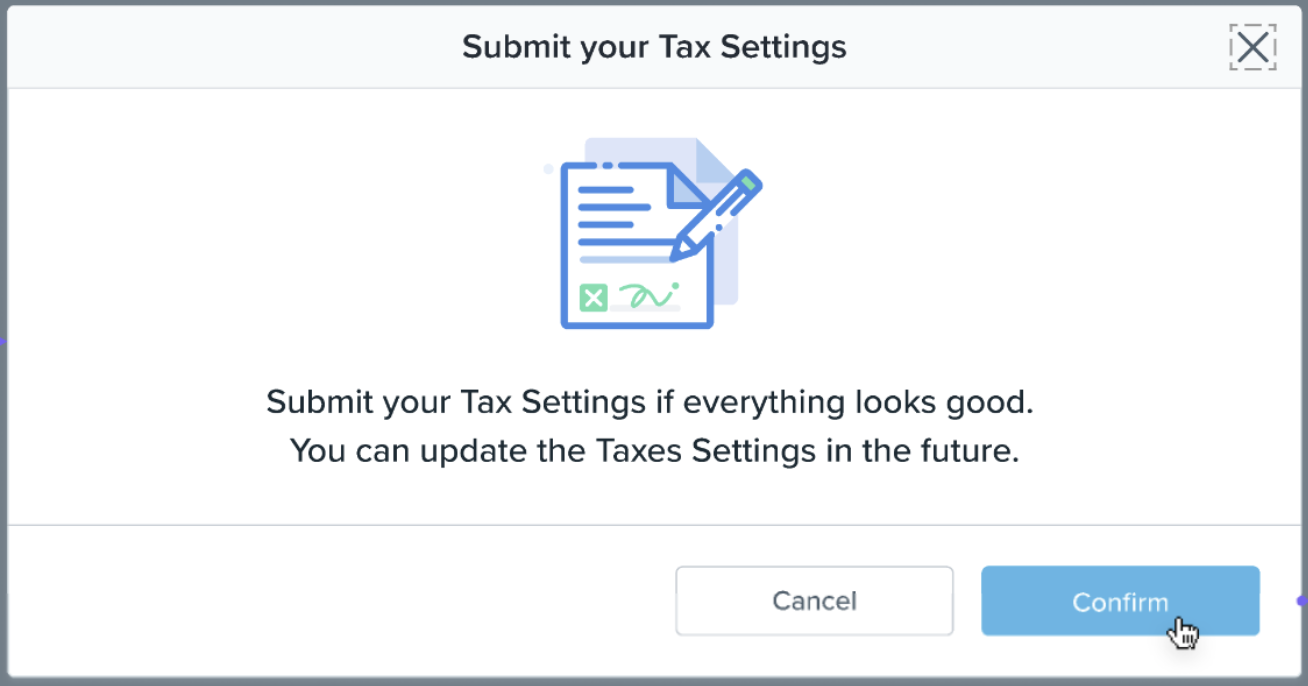

5. 在随后的弹窗中点击“确认”:

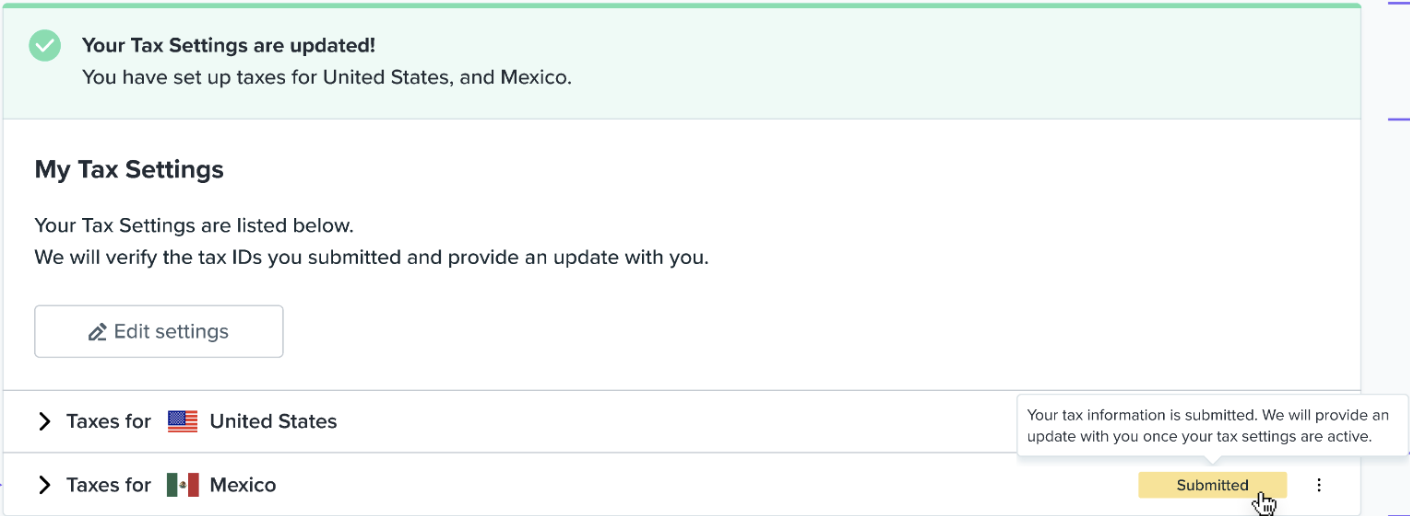

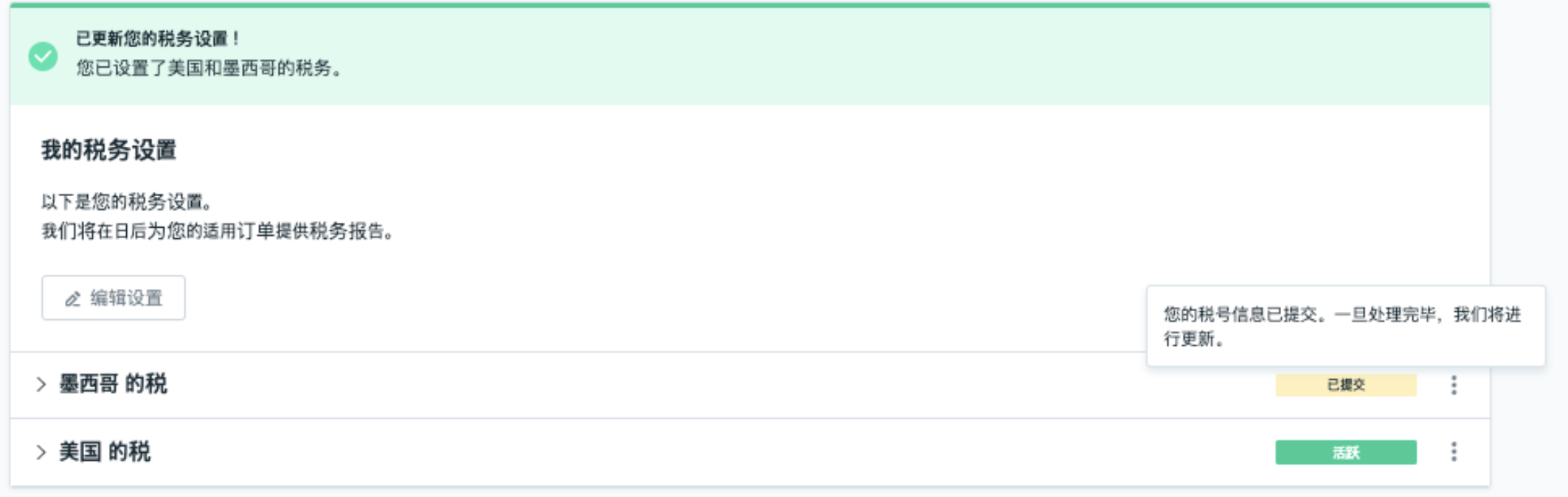

6. 然后,页面将跳转回“税务设置”主页,您可以在此页面查看您提交的税务信息,修改税务设置或删除某些税务设置:

如需 Wish 客服协助解决税务设置问题,请发送电子邮件至 taxsettings@wish.com。请在邮件中提供您的商户 ID 以及问题说明,另请务必将电子邮件抄送您的客户经理,以便wish平台能够及时审核并解决您的问题。

wish商户官网原文详情:

How to provide your valid RFC ID via Tax Settings for Mexico VAT calculation?

To help merchants comply with the Mexico Tax Reform legislation introduced by the Mexican government in December 2019, Wish has rolled out multiple features available to relevant merchants on the Merchant Dashboard. This article walks merchants through how Wish helps collect and remit Value Added Tax (VAT) and income tax specific to the Mexico Tax Reform.

Please note that information provided in this article does NOT constitute tax, legal, or other professional advice.

Value Added Tax (VAT)

New tax reform legislation introduced by the Mexican government requires Wish to act as a withholding agent for Value Added Tax (VAT) on the sales the merchants conduct through our platform. VAT applies to sales made on the Wish platform if goods are shipped from an address in Mexico AND the ship-to address (destination) is located in Mexico.

Important: Merchants’ Registro Federal de Contribuyentes identification number (RFC ID) will determine how Wish will collect VAT from your sales.

Effective December 21, 2020 8:00PM UTC, Wish will begin collecting Mexico VAT on the sale (price displayed to customers includes 16% VAT) of products that the merchants have offered to customers in Mexico whenever VAT is applicable. If you provided your valid RFC ID to Wish:

As a Business (persona moral): 100% of collected VAT from your sales will be remitted to you, which you can subsequently remit to the Mexican government.

As an Individual (persona física): 50% of collected VAT from your sales will be remitted to you that you are advised to remit to the Mexican government. The other 50% will be remitted directly to the Mexican government by Wish.

If you have not provided your valid RFC ID to Wish, you should expect that 100% of collected VAT on your sales (16%) will be withheld and remitted to the Mexican government by Wish.

How to provide RFC ID to Wish?

1. On the Merchant Dashboard, navigate to Account > Tax Settings on Merchant Dashboard. If you have not previously validated your store, please click “Validate my store” to further access Tax Settings (to learn more about how to validate your store, please visit this FAQ). If you have already validated your store, click “Set up now” to start:

2. Next, click Mexico on the table to set up taxes for Mexico, and click “Continue”:

3. You are able to provide your RFC ID on the page that follows:

Note that on this page:

The “Account type” is based on the information you provided when validating your store

For inputting a valid RFC ID:

If your account type is individual (persona fisica), your RFC ID is 13 characters long and is made up of letters and numbers.

If your account type is Business (persona moral), your RFC ID is 12 characters long and is made up of letters and numbers

For Mexico-bound orders, you may select the default ship-from location. Your selection may be used to calculate VAT at the time of customer purchase (see calculation details above).

After providing the correct information, click “Continue”.

4. The next page allows you to view a summary of the tax information you’ve entered. Click the checkbox at the bottom to indicate your agreement that you are responsible for the accuracy of any information you’ve provided and for the collection, reporting, and payment of all taxes to the appropriate authorities. You also agree to the Wish Merchant Tax Policy by clicking “Submit”:

5. In the popup modal that follows, click “Confirm”:

6. You’re then redirected back to the Tax Settings homepage, where you can view your submitted tax information, edit tax settings, or delete certain tax settings:

To receive support for issues with your Tax Settings, please email Wish at taxsettings@wish.com. When you reach out, please include your Merchant ID and a description of the issues you encounter; be sure to copy your Account Manager in your email as well, so we can review and address your question in a timely manner.

文章内容来源:wish商户官方网站

上一篇:Wish平台知识产权规则

下一篇:wish商户平台API相关信息