wish如何查找欧盟海关报关需要的订单信息(下)(适用于从欧盟境外发货的欧盟路向订单)

wish如何查找欧盟海关报关需要的订单信息(下)(适用于从欧盟境外发货的欧盟路向订单)

2. 从欧盟境外和中国大陆以外发货的欧盟路向订单

从欧盟境外和中国大陆以外发货至欧盟境内时,wish商户需要向物流服务商额外提供报关所需的订单信息。这些信息可通过商户平台/Merchant Plus 平台和 API 获得。

通过wish商户平台或 Merchant Plus 平台

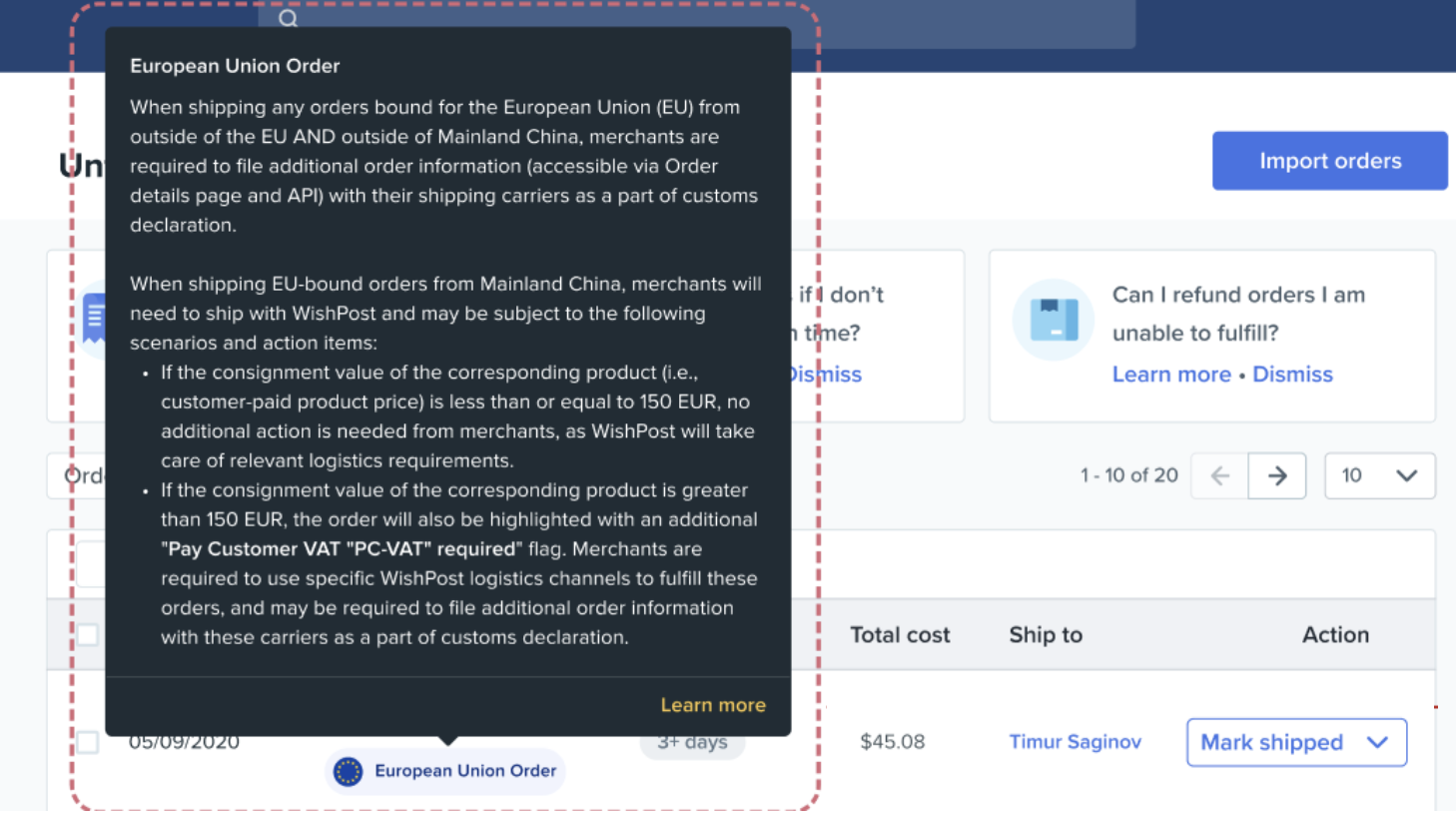

对于 CEST 时间2021年6月26日凌晨0时(即 UTC 时间2021年6月25日晚10时)及之后释放的相关订单,从 CEST 时间2021年7月1日凌晨0时起,这些订单在wish商户平台的订单 > 未履行的订单和订单 > 历史记录页面(或者 Merchant Plus 平台的未履行的订单和订单历史记录页面)上将显示“欧盟订单”标记。当商户将鼠标悬停在该标记上时,可以看到以下提示:

要查看报关所需的订单信息,请在订单的“操作”栏点击“查看详情”,然后转到订单的订单详情页。

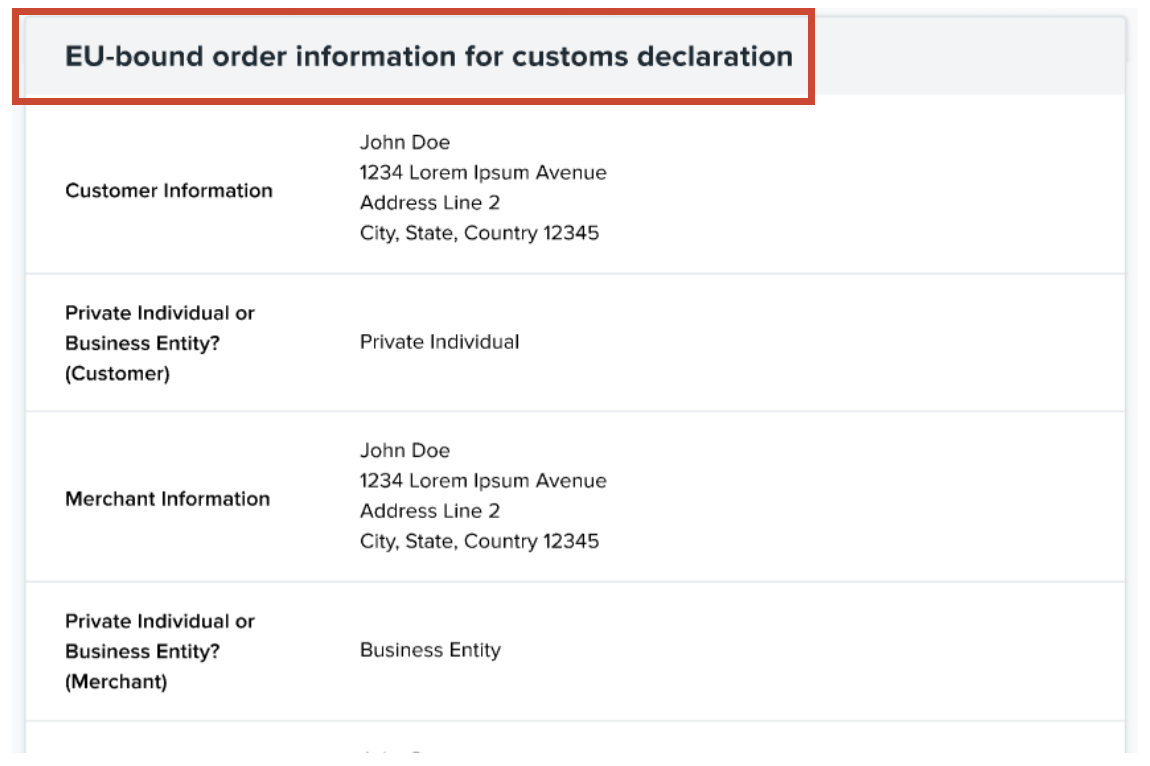

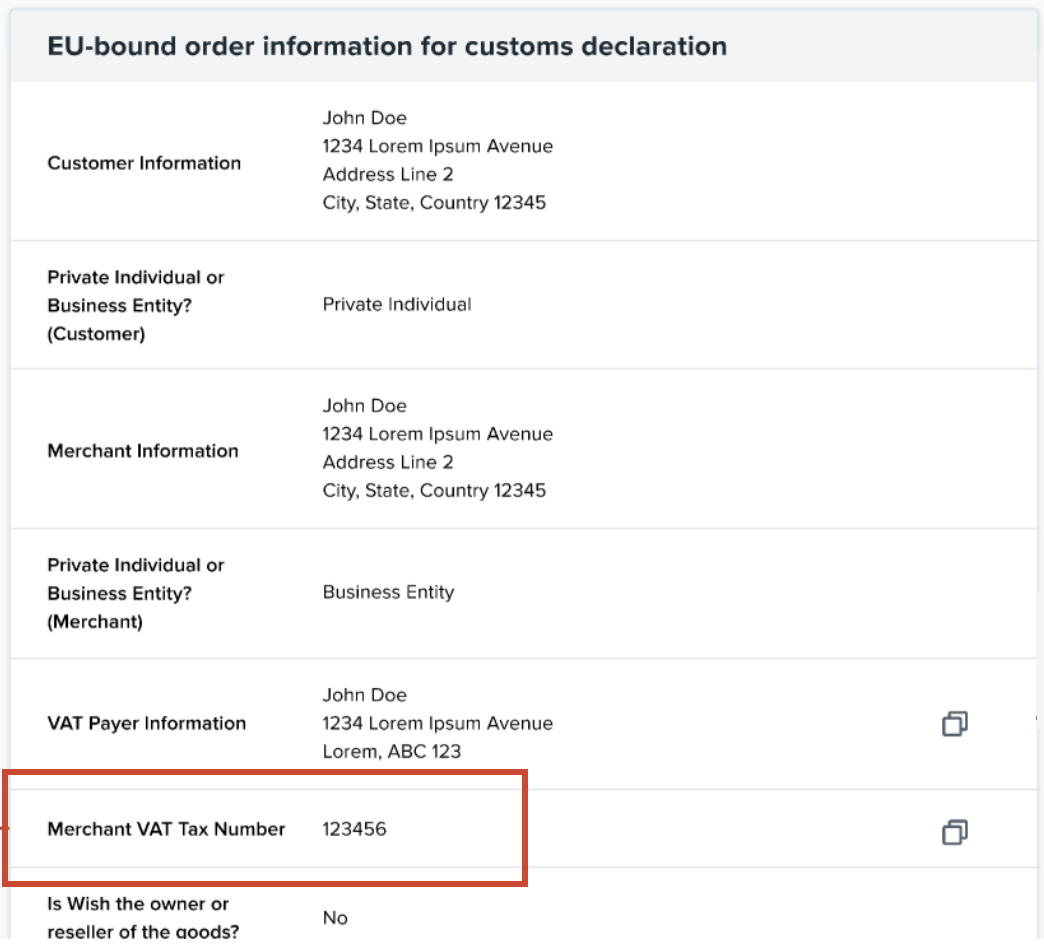

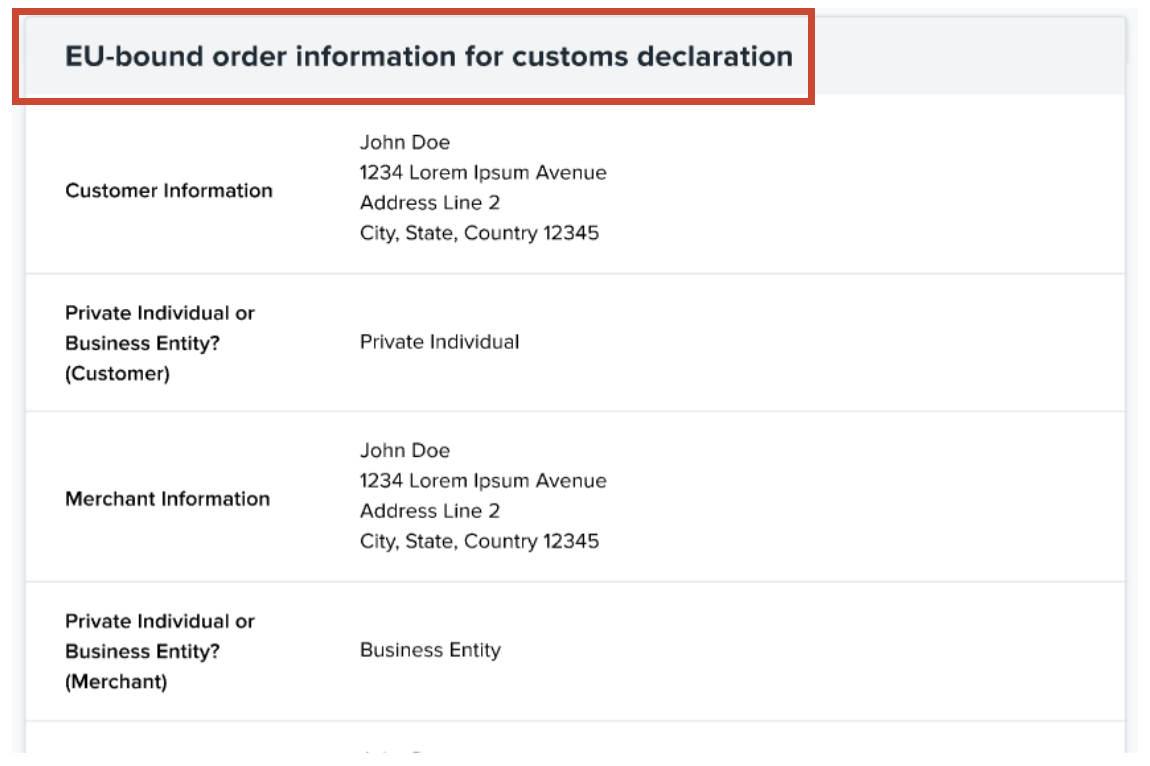

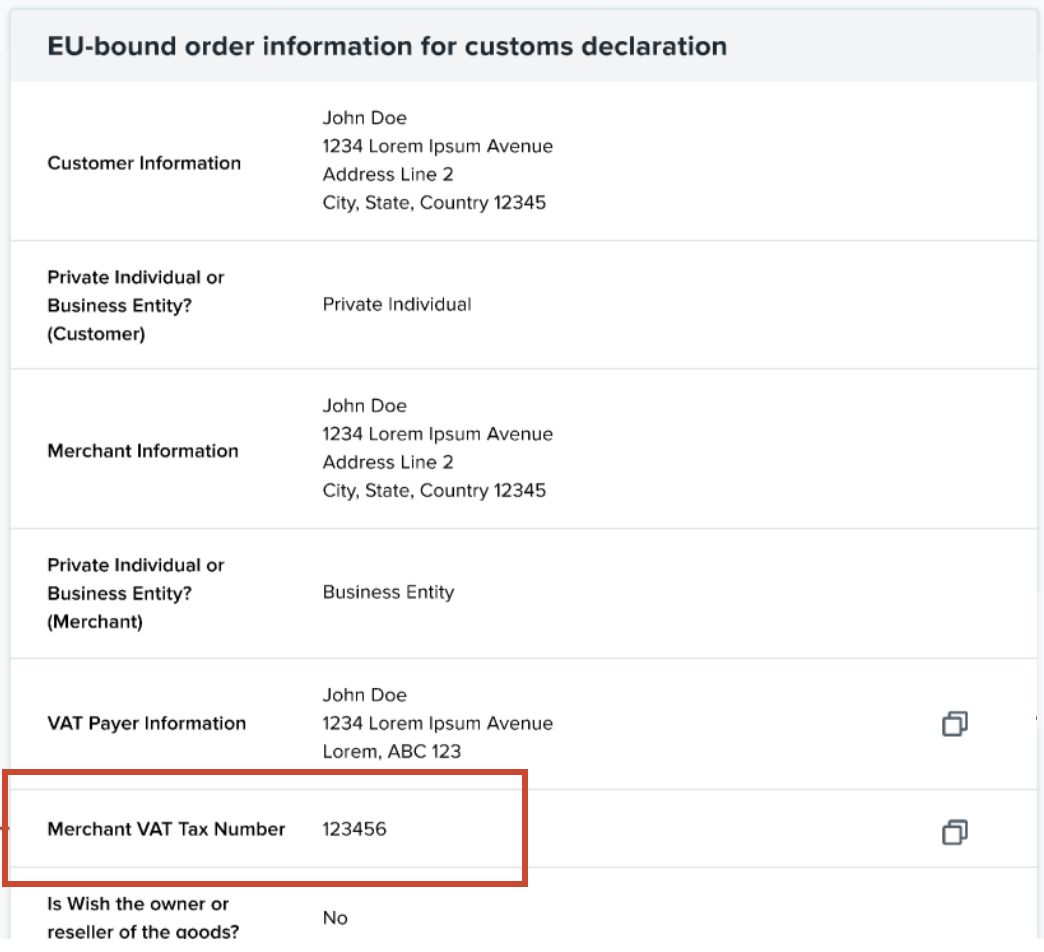

在“订单详情”页的“产品详情”部分,商户会看到一个新的版块,叫做“欧盟路向订单报关信息”,其中包含需要提供给物流服务商的所有信息。商户可将这些信息提供给物流服务商,可以采取物流服务商能够接受的任何格式提供(若可以,强烈建议采用电子格式):

请注意有以下两种情况:

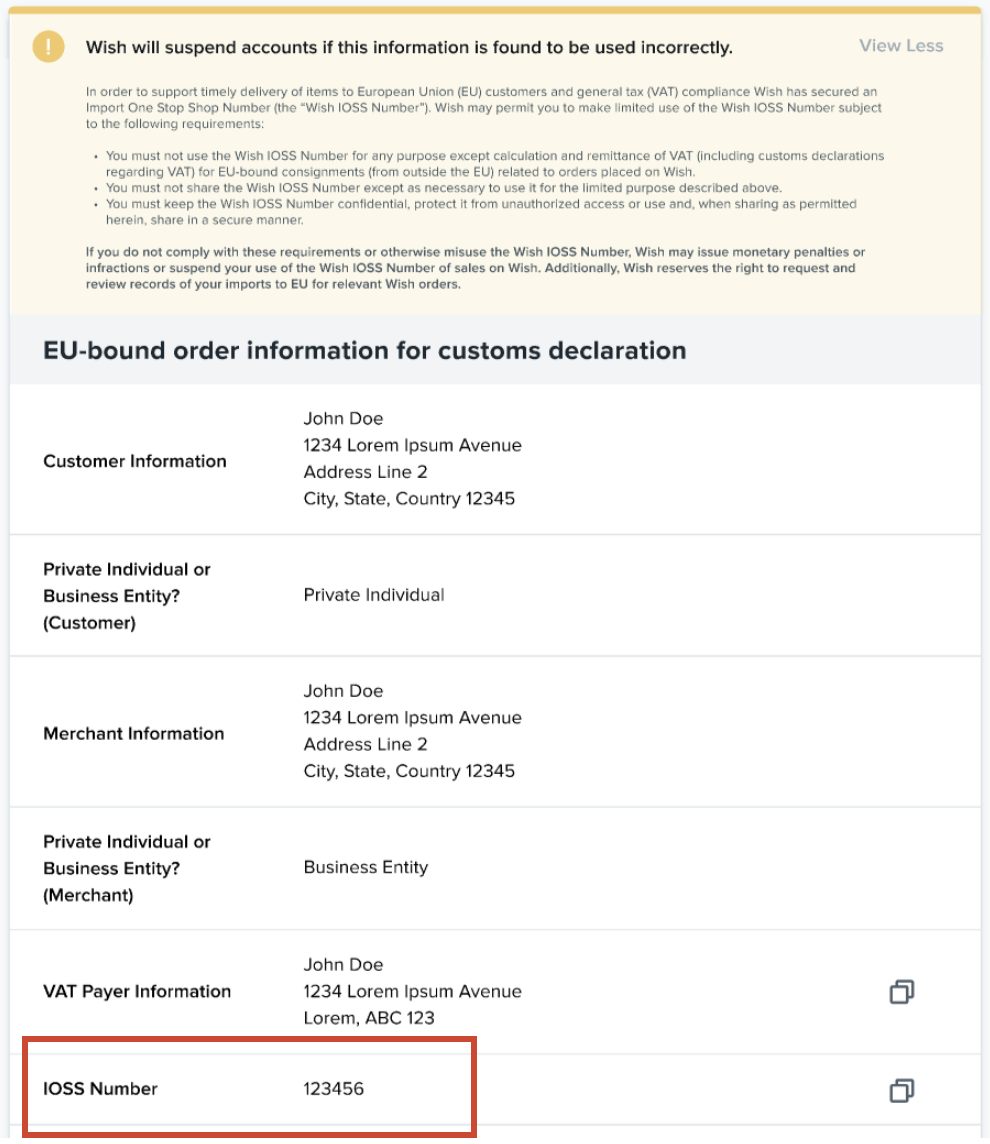

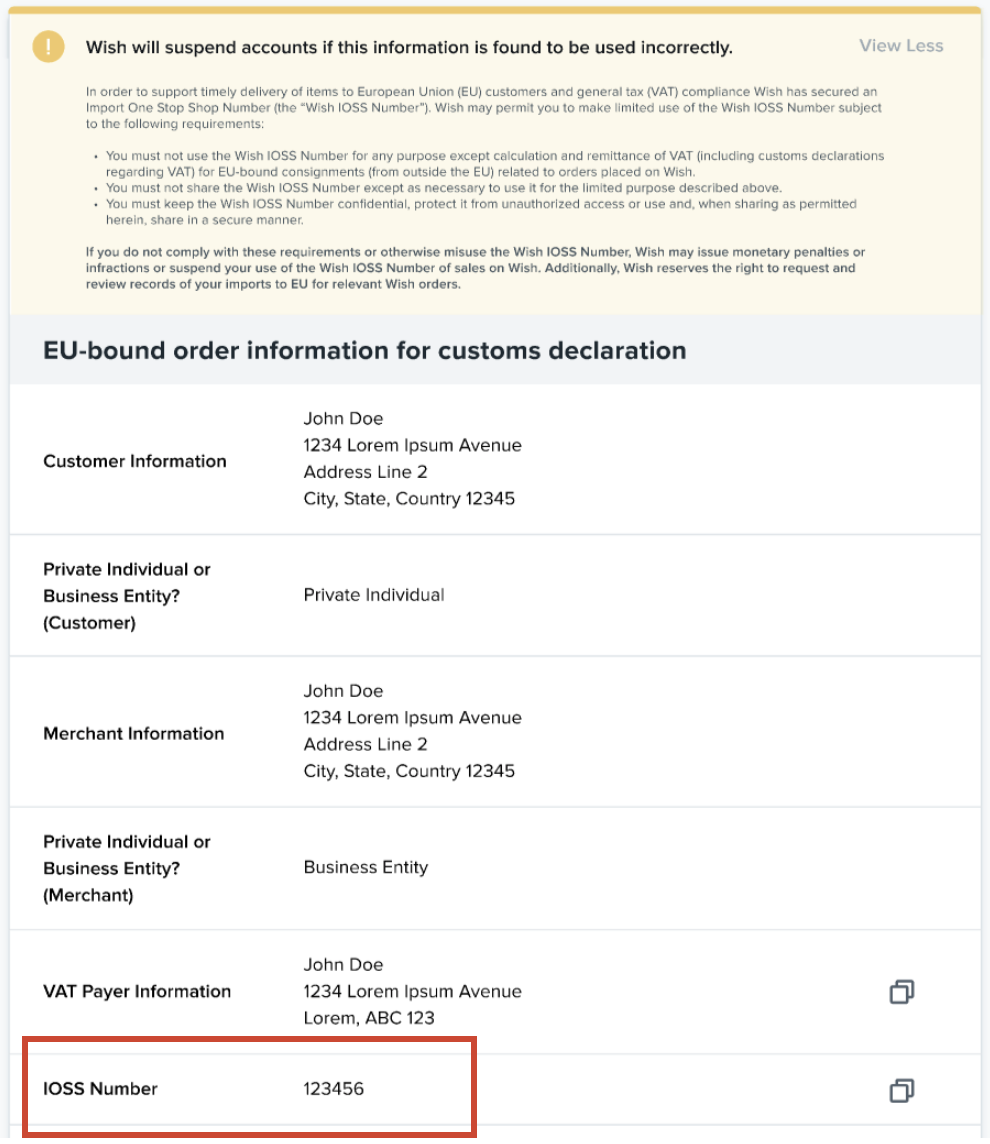

A. 如果产品的货值(即,用户支付的产品价格)小于或等于150欧元,Wish 可能允许商户在遵守特定要求的情况下使用 Wish 的进口一站式服务号码(即“Wish IOSS 号码”,如下图所示)。使用此号码必须满足特定的要求,具体要求将在适用情形下以警告消息的形式显示,如下文详述。

请注意,以任何方式滥用 IOSS 号码(包括以任何数字或物理方式离线保存此信息)都可能会导致商户被处以赔款、违规和/或被暂停销售/封禁账户。请在使用此号码之前认真阅读警告消息。

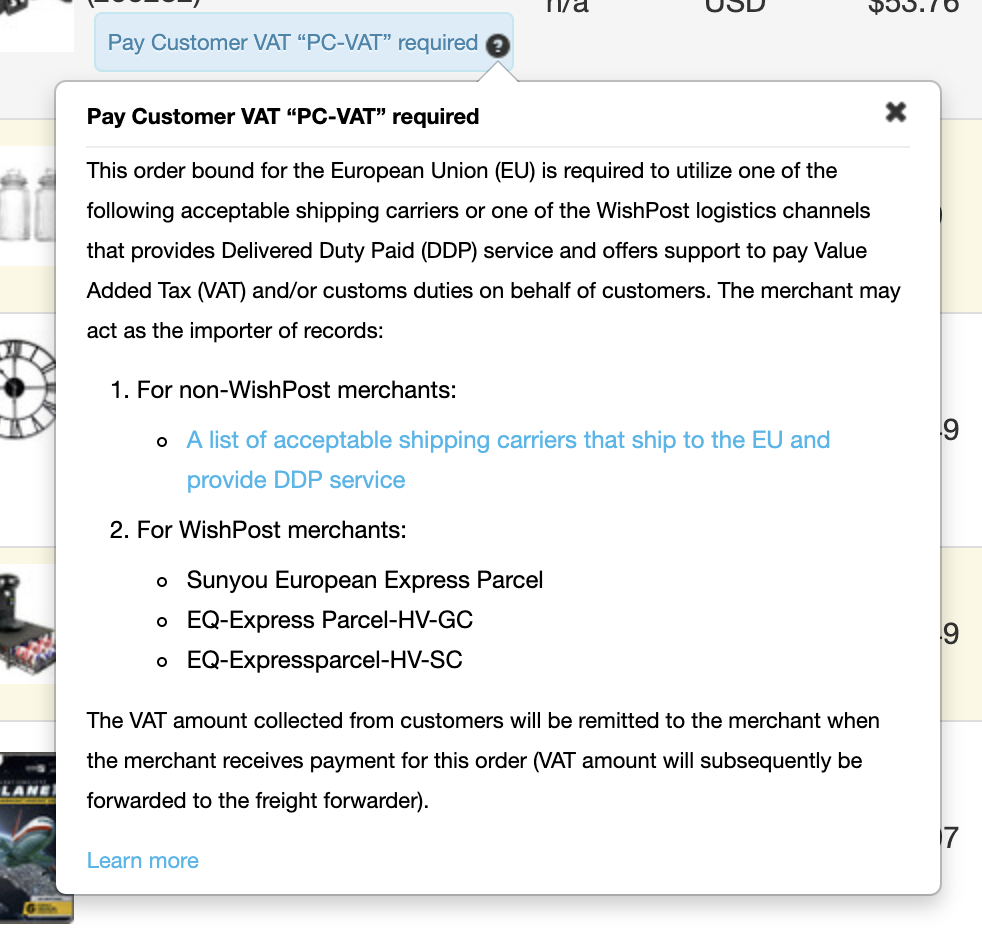

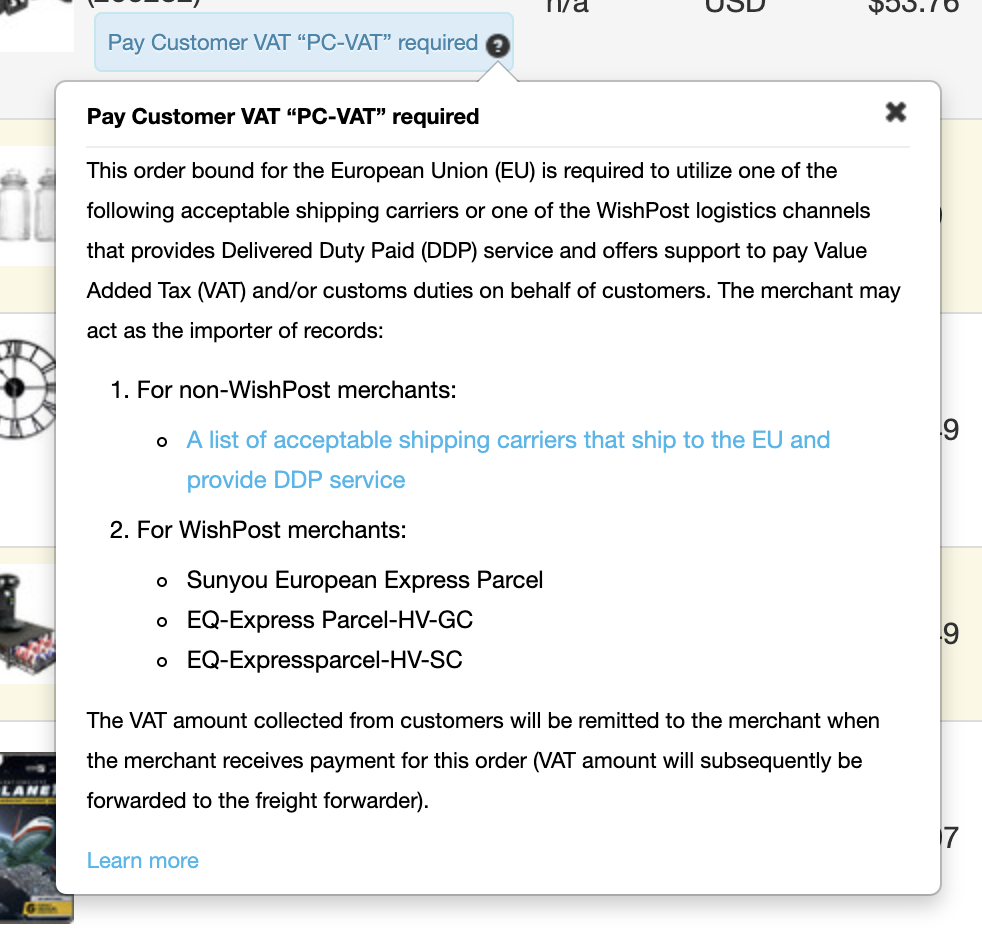

B. 如果产品的货值(即用户支付的产品价格)大于150欧元,则在商户平台的订单 > 未履行的订单页面或 Merchant Plus 平台的未履行的订单页面上,该欧盟路向订单还会带有“要求支付消费者 VAT”标记。

此类订单必须使用 Wish 认可的物流服务商之一来履行,这些物流服务商可提供完税后交货 (DDP) 服务,并且可协助(向海关)代缴 Wish 收取的增值税和/或关税。请点击此处,查看 Wish 认可的物流服务商名单。

由于货值大于150欧盟的订单须办理正式报关手续,并须缴纳适用关税,因此商户需要负责(可与指定的 DDP 物流服务商协商)确定由谁作为包裹的“登记进口商”(Importer of Record),以及如何处理/支付额外的费用。

如需了解关于带“要求支付消费者 VAT”标记的欧盟路向订单的更多信息,请点击此处。

请注意,这种情况下虽然商户需要向物流服务商额外提供报关所需的订单信息,但商户将不需要提供“Wish IOSS 号码”,因为包裹价值大于150欧元超出了 IOSS 代缴范围。相反,wish商户平台会在“订单详情”页显示“商户增值税号码”:

wish商户官网原文详情:

2. Shipping to the EU from outside of the EU AND outside of Mainland China

When shipping any EU-bound orders from outside of the EU AND outside of Mainland China, merchants are required to file/share additional order information with their shipping carriers as a part of customs declaration. This additional information is accessible via Merchant Dashboard / Merchant Plus dashboard and API.

Via Merchant Dashboard / or Merchant Plus dashboard

Relevant orders released on or after June 26, 2021 12:00AM CEST (i.e., June 25, 2021 10:00PM UTC) will be marked with a “European Union Order” flag in the Orders > Unfulfilled Orders page and Orders > History page on Merchant Dashboard (or Merchant Plus dashboard’s corresponding Unfulfilled Orders and Order History page), starting July 1, 2021 12:00AM CEST. When hovering over the flag, merchants will see the following tooltip:

To access the order information for customs declaration, click “View details” under the “Action” column of the corresponding order and navigate to the order’s Order details page.

Under the “Product details” section of the Order details page, merchants will find a new section called “EU-bound order information for customs declaration”, which contains all information necessary to file/share with shipping carriers. Merchants may supply this information in any format acceptable by the shipping carriers (electronic submission is strongly preferred/recommended, if this option exists):

Please note the following two different scenarios:

A. If the consignment value of the order (i.e., customer-paid product price) is less than or equal to €150, Wish may permit merchants to make limited use of its Import One Stop Shop Number (the “Wish IOSS Number”, as shown in the screenshot below). This number is subject to specific requirements, as outlined in a warning message that will appear in applicable scenarios, detailed below.

Note that any misuse (including storing this information offline via any digital or physical methods) of the IOSS number may result in penalties, infractions, and/or suspension of merchant sales/accounts. Please review the message carefully before using this number.

B. If the consignment value of the corresponding product (i.e., customer-paid product price) is greater than €150, an additional “Pay Customer VAT “PC-VAT” required” flag will be shown on the Merchant Dashboard Orders > Unfulfilled Orders page or Merchant Plus dashboard Unfulfilled Orders page for this particular EU-bound order.

This type of order is required to use one of the acceptable shipping carriers that provides Delivered Duty Paid (DDP) service and offers support to remit (at customs) VAT amount collected by Wish and/or customs duties. The list of acceptable carriers can be found here.

As orders with consignment value greater than €150 will require formal customs entry and associated duty payment, it will be up to the merchant, in coordination with the appointed DDP carrier, to determine who should act as the “Importer of Record” for these parcels and how the additional costs will be managed/paid.

Learn more about EU-bound orders flagged as “Pay Customer VAT “PC-VAT” required” here.

Please note that though merchants will be required to provide carriers with additional order information in order to complete the customs declarations, merchants will NOT need the “Wish IOSS Number” in this situation, as consignments greater than €150 exist outside of the IOSS remittance scheme. Instead, we will show a “Merchant VAT Tax Number” line item on the Order details page:

文章内容来源:wish商户官方网站