wish平台挪威增值税介绍(下)

自2020年4月1日起,对于从挪威境外发往挪威境内且用户支付的产品单价(不含运费和保险等由用户支付的其他所有费用)低于3,000挪威克朗的订单,Wish 被登记为交易平台。

这意味着自2020年4月1日起,对于从挪威境外发往挪威境内且用户支付的产品单价(不含运费和保险等由用户支付的其他所有费用)低于3,000挪威克朗的订单,将由 Wish 计算并代收代缴相关增值税。

自2020年4月1日起,从不同发货地点配送订单的商户应注意以下事项:

1. 对于使用 WishPost 从中国大陆发货的商户:

对于用户支付的产品单价低于3,000挪威克朗的 WishPost 配送订单,物流标签上会自动包含 VOEC 号码。

2. 对于从中国大陆以外发货的商户:

对于用户支付的产品单价低于3,000挪威克朗的订单,需由商户负责在物流标签上提供 VOEC 号码。

商户可以直接在商户平台上或通过 API 查找每个相关订单的 VOEC 号码。

通过wish商户平台:

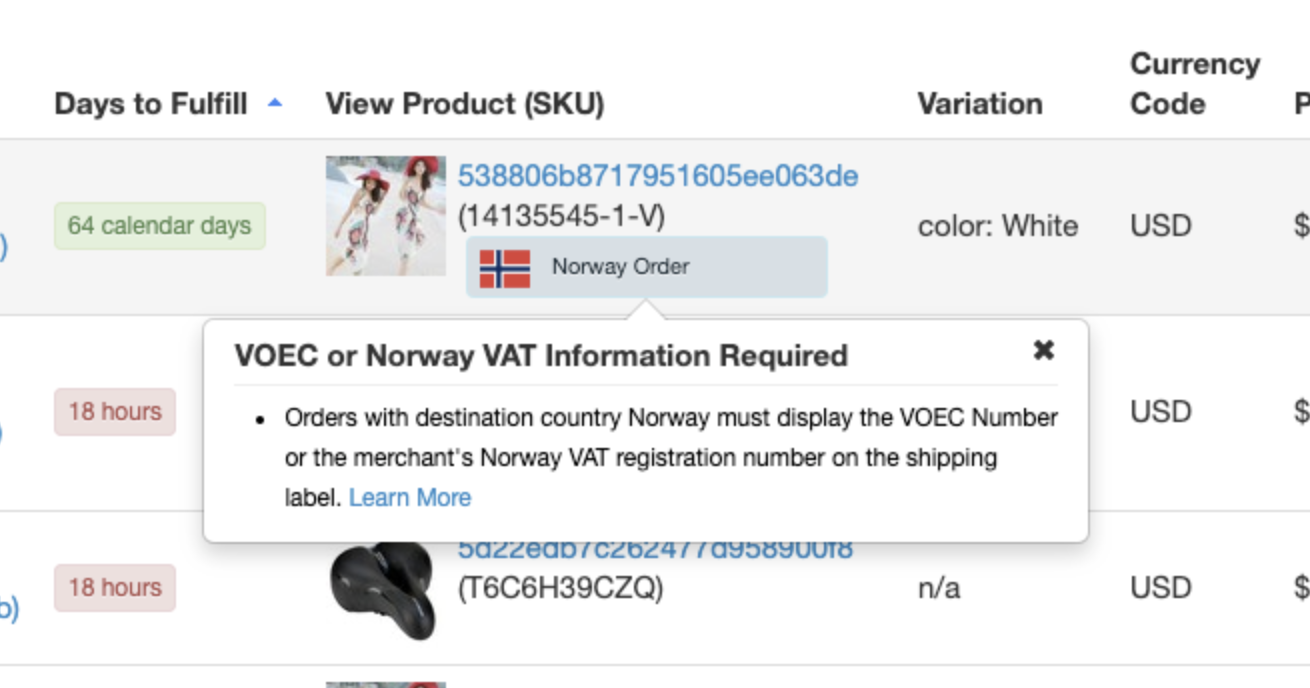

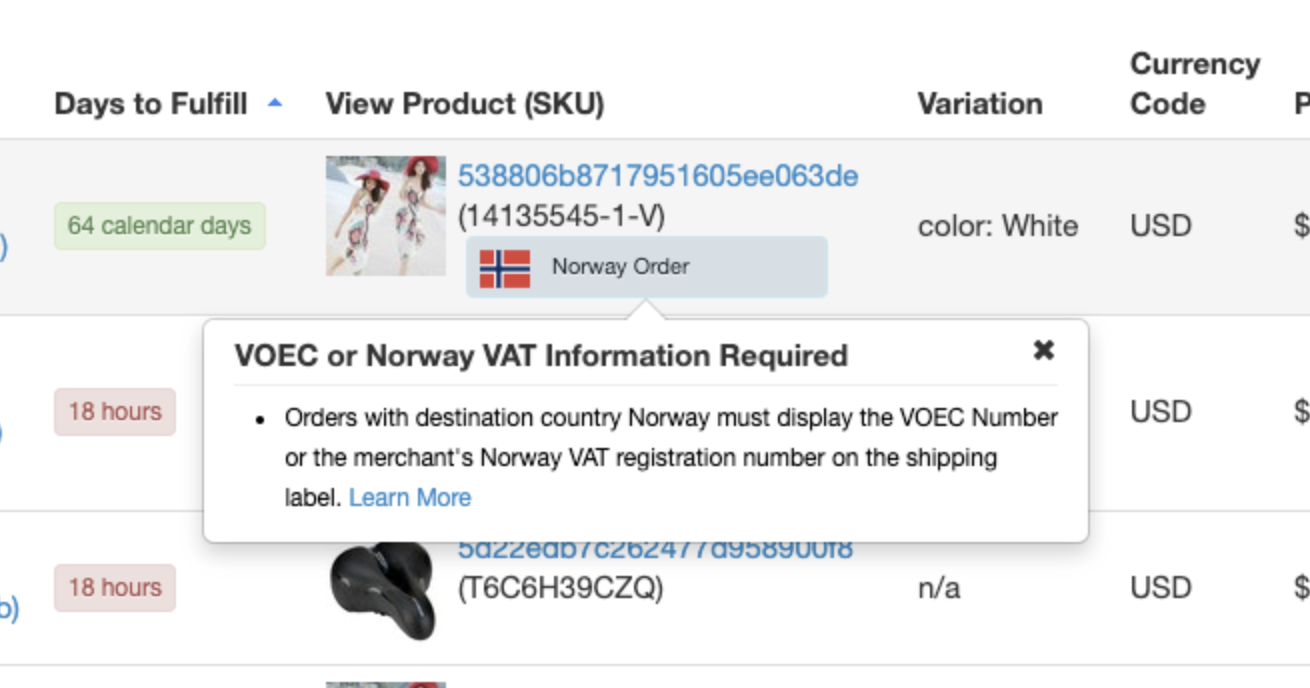

首先,对于挪威路向订单,在商户平台的订单 > 未履行的订单或订单 > 历史记录页面,商户可以看到如下所示的“挪威订单”标记。点击此标记后,商户将看到相关工具提示。

例如,下图为订单 > 历史记录页面显示的标记和工具提示:

商户目前只需在相关订单的物流标签上提供 VOEC 号码。获得挪威增值税号码后,我们会立即通知商户。

接下来,商户可在订单 > 未履行的订单或订单 > 历史记录页面点击相应订单的“收货地址”栏中的链接,在随后出现的弹窗底部找到 VOEC 号码。

下图是订单 > 历史记录页面显示的 VOEC 号码示例:

商户也可以前往每个相关订单的“订单详情”页面,在“订单概览”部分找到 VOEC 号码:

通过 API:

商户可以通过以下 API 端口检索 VOEC 号码:

/api/v2/order

/api/v2/order/multi-get

/api/v2/order/get-fulfill

如需了解更多详情,请参阅此 API 文档。

请注意,正确理解“税务设置”中规定的申报义务、确保履行销售税/增值税合规义务并准确提交申报表的最终责任由商户自己承担。

wish商户官网原文详情:

To comply with the above requirement starting April 1, 2020, merchants shipping from different originating locations should note the following:

1. For merchants shipping from Mainland China using WishPost:

The shipping label of a WishPost shipping order with customer-paid price per item less than NOK 3,000 will automatically include a VOEC number for merchants.

2. For merchants shipping from outside of Mainland China:

Merchants are responsible for including the VOEC number on the shipping labels of orders with customer-paid price per item less than NOK 3,000.

Merchants are able to find each relevant order’s VOEC number directly in Merchant Dashboard or via API.

Via Merchant Dashboard:

First of all, for Norway-bound orders on the Merchant Dashboard Orders > Unfulfilled Orders page or Orders > History page, merchants will be able to see a “Norway Order” flag, as shown below. After clicking on the flag, merchants will see a relevant tooltip.

For example, the screenshot below shows how this flag and tooltip will appear on the Orders > History page:

Currently, merchants only need to provide VOEC on the shipping labels of relevant orders. We will inform merchants when the Norway VAT registration number is available.

Next, merchants may click the link below the “Ship to” column for the corresponding order on the Orders > Unfulfilled Orders page or Orders > History page, and locate the VOEC number at the bottom of the popup modal that follows.

See below for an example shown on the Orders > History page:

Alternatively, merchants may also find the VOEC number by navigating to the "Order details" page and the "Order overview" section of the page for each relevant orders:

Via API:

Merchants are able to retrieve the VOEC number via the following API endpoints:

/api/v2/order

/api/v2/order/multi-get

/api/v2/order/get-fulfill

Merchants may refer to this API Documentation to learn more.

Please note that merchants are ultimately responsible for correctly identifying their filing obligations in the Tax Settings and ensuring their sales tax/VAT compliance obligations are met and returns are submitted accurately.

文章内容来源:wish商户官方网站

上一篇:Wish卖家如何避免没货退款

下一篇:Wish美国退货项目常见问题解答