wish如何查找欧盟海关报关需要的订单信息(上)(适用于从欧盟境外发货的欧盟路向订单)

如何查找欧盟海关报关需要的订单信息(上)(适用于从欧盟境外发货的欧盟路向订单)

下文是介绍 CEST 时间2021年7月1日凌晨0时生效的欧盟履单要求的系列文章中的其中一篇。如需了解更多信息,请点击此处。

为了遵守2021年7月1日生效的欧盟增值税新规,从欧盟境外发货到欧盟境内的wish商户可能需要向物流服务商额外提供报关所需的订单信息(便于填写必要的报关单)。

请注意,并非所有从欧盟境外发货到欧盟境内的商户都需要进行额外的操作。本文概述了不同情况下商户需要执行的具体操作。

1. 从中国大陆发货的欧盟路向订单

通过 A+ 物流计划或 WishPost 智选项目从中国大陆发货到欧盟境内的商户,不需要执行下述任何额外操作来满足物流或报关要求,因为这两个项目将负责完成此类订单需要的所有操作。

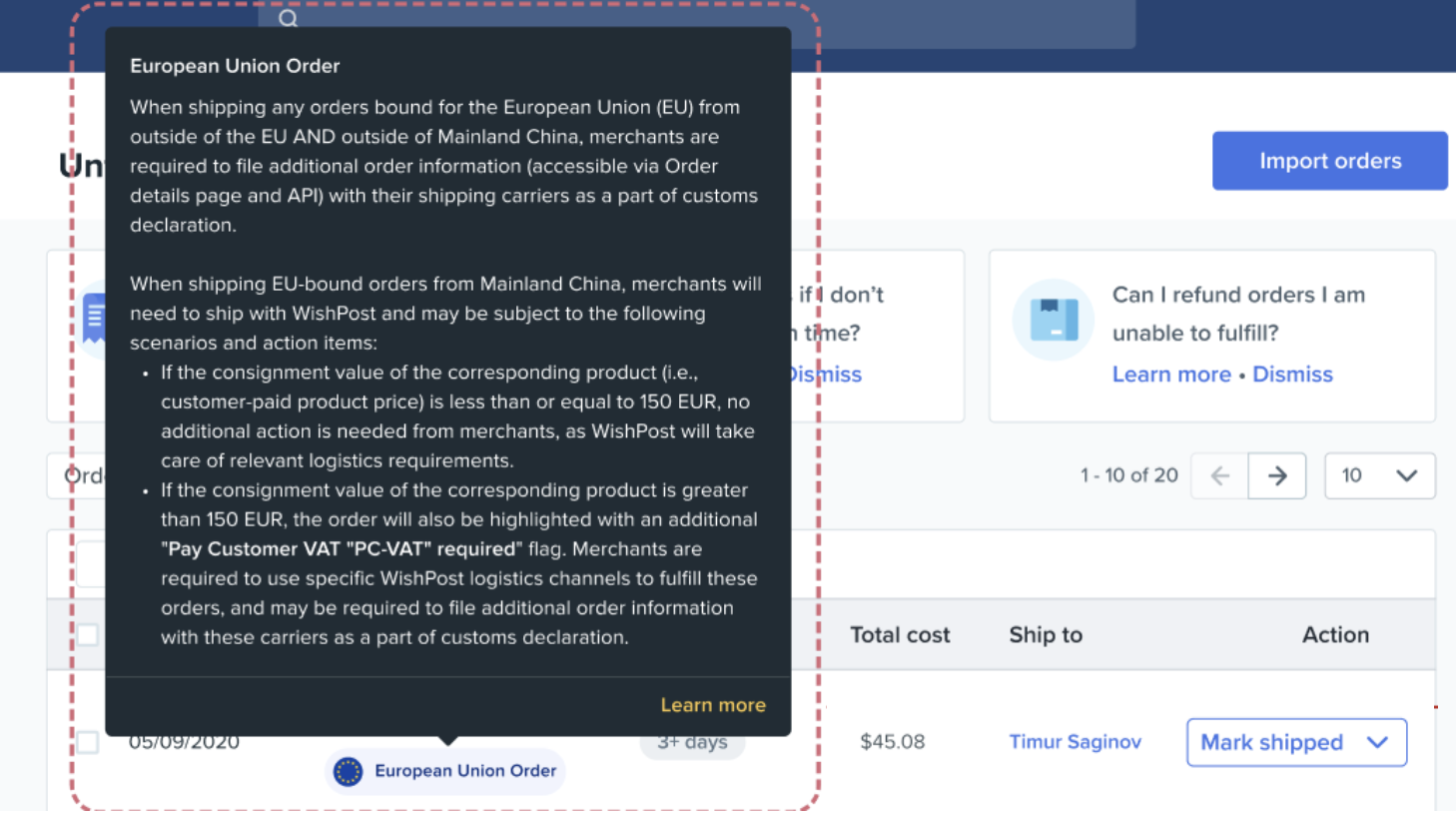

另一方面,对于 CEST 时间2021年6月26日凌晨0时(即 UTC 时间2021年6月25日晚10时)及之后释放的欧盟路向直发订单,从 CEST 时间2021年7月1日凌晨0时起,这些订单在wish商户平台的订单 > 未履行的订单和订单 > 历史记录页面(或者 Merchant Plus 平台的未履行的订单和订单历史记录页面)上将显示“欧盟订单”标记,商户可通过 WishPost 第三方物流 (3PL) 渠道配送这些订单。当wish商户将鼠标悬停在该标记上时,可以看到以下提示:

具体来说,通过 WishPost 3PL 渠道从中国大陆履行欧盟路向订单时,wish商户可能需要根据情况执行不同的操作:

如果产品的货值(即,用户支付的产品价格)小于或等于150欧元,将由 WishPost 负责处理相关的物流和报关要求,无需商户执行额外操作。

如果产品的货值大于150欧元,则该订单还会带有“要求支付消费者 VAT”标记。

要查看报关所需的订单信息,请在订单的“操作”栏点击“查看详情”,然后转到订单的订单详情页。

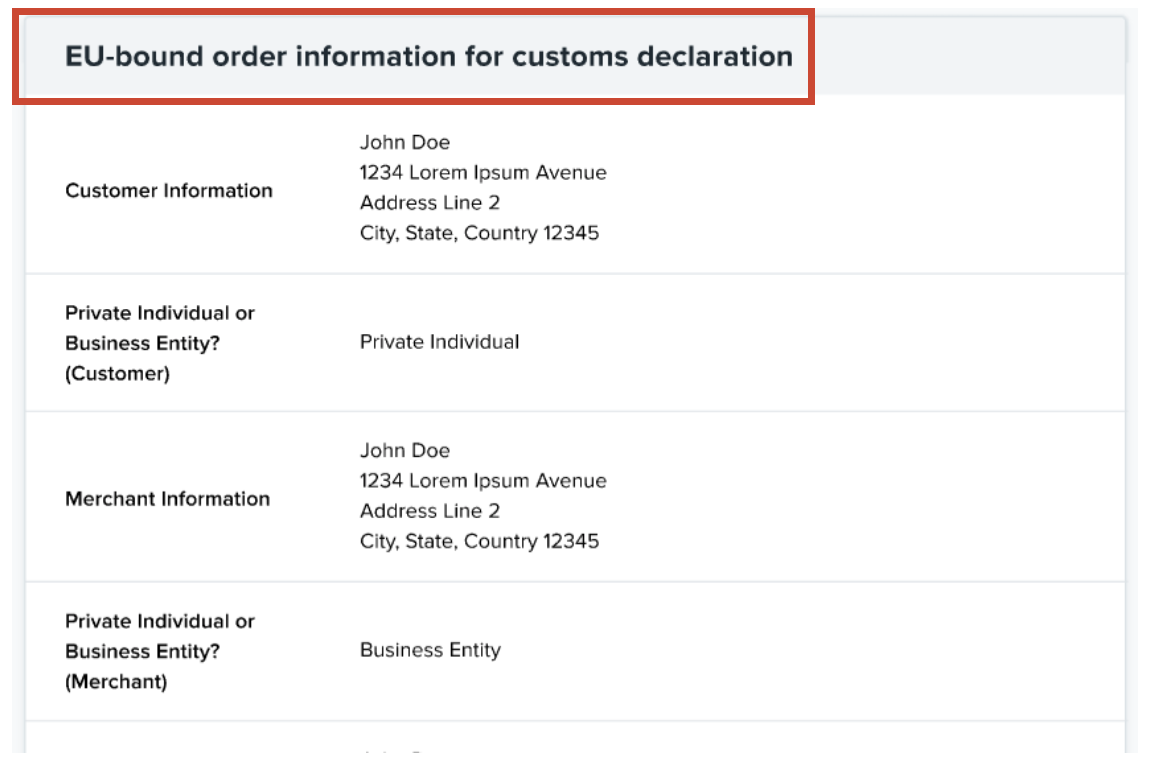

在“订单详情”页的“产品详情”部分,商户会看到一个新的版块,叫做“欧盟路向订单报关信息”,其中包含需要提供给物流服务商的所有信息。商户可将这些信息提供给上述三个 WishPost 物流渠道的物流服务商,可以采取物流服务商能够接受的任何格式提供(若可以,强烈建议采用电子格式):

商户也可以通过 V2 和 V3 版 API 端口获取这些信息。具体如下:

V2 版 API 端口:商户可在以下 V2 版订单相关 API 端口使用新增加的“eu_vat_info”属性获取这些信息

V3 版 API 端口:商户在以下 V3 版订单相关 API 端口使用新增加的“eu_vat_customs_declaration”属性获取这些信息:

检索某个订单:GET https://merchant.wish.com/api/v2/order

检索最近更改的订单:GET https://merchant.wish.com/api/v2/order/multi-get

检索最近更改的 FBW 订单:GET https://merchant.wish.com/api/v2/order/multi-get-fbw

检索最近更改的 FBS 订单:GET https://merchant.wish.com/api/v2/order/multi-get-fbs

检索未履行的订单:GET https://merchant.wish.com/api/v2/order/get-fulfill

查找某个订单:GET https://merchant.wish.com/api/v3/orders/%7Bid%7D

列出多个订单:GET https://merchant.wish.com/api/v3/orders

顺友欧洲快速专线

EQ 专线快递-高值普货

EQ 专线快递-高值特货

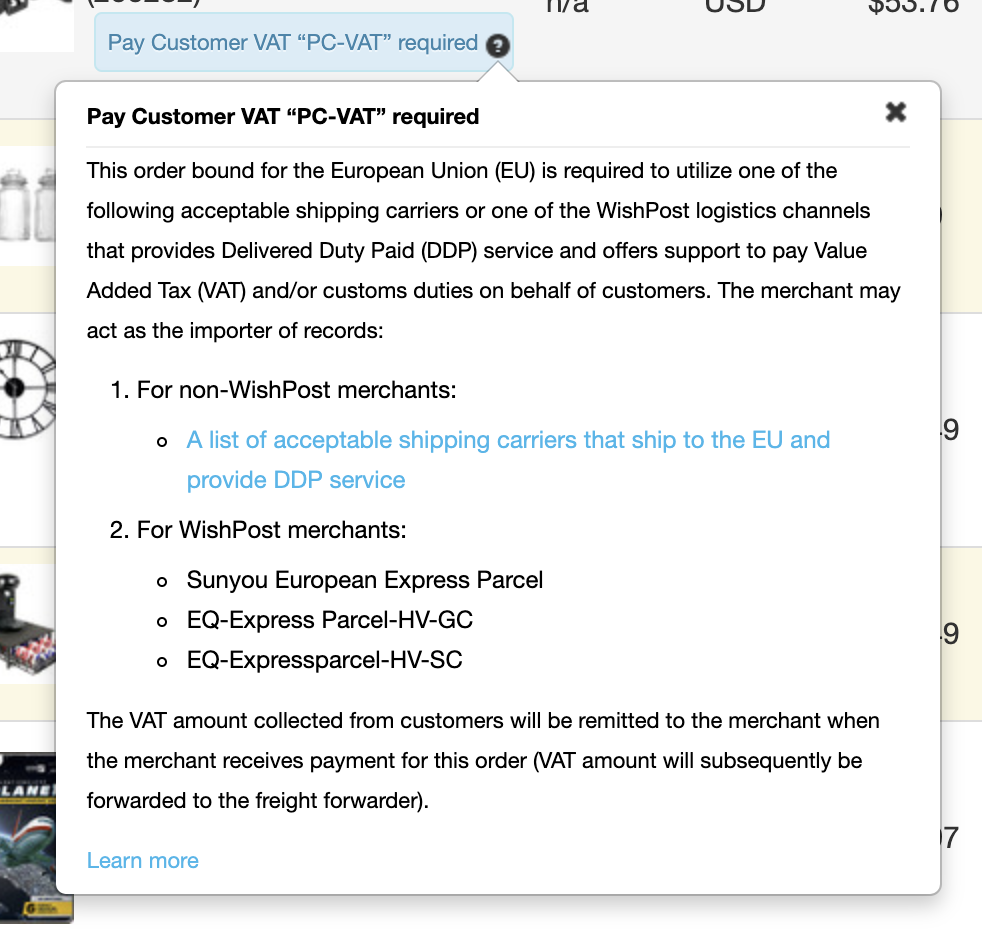

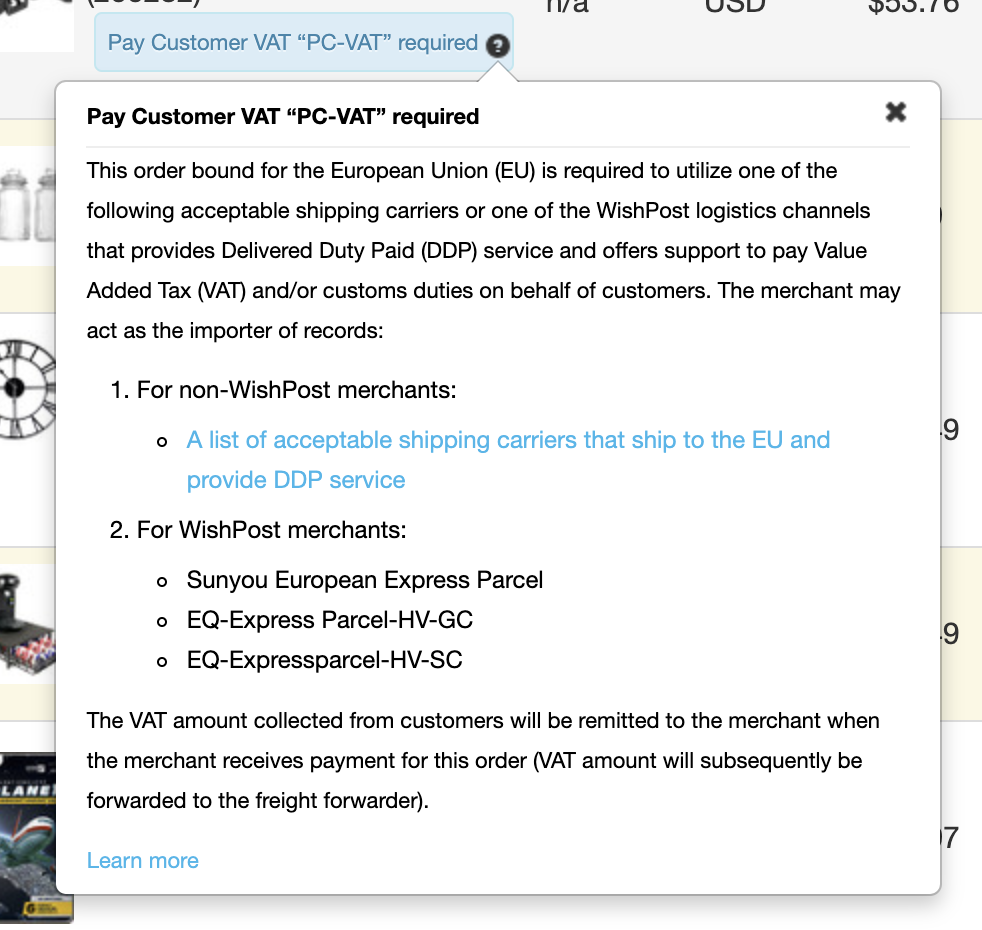

商户必须使用下列三个 WishPost 物流渠道之一来履行这些订单,因为这些物流服务商可提供完税后交货 (DDP) 服务,并且可协助(向海关)代缴 Wish 收取的增值税和/或关税:

由于货值大于150欧盟的订单须办理正式报关手续,并须缴纳适用关税,因此商户需要负责(可与指定的 DDP 物流服务商协商)确定由谁作为包裹的“登记进口商”(Importer of Record),以及如何处理/支付额外的费用。

如需了解关于带“要求支付消费者 VAT”标记的欧盟路向订单的更多信息,请点击此处。

商户需要向物流服务商额外提供报关所需的订单信息。

具体来说,“eu_vat_customs_declaration”可从 order → tax_information → vat_information → eu_vat_customs_declaration 属性中找到。

wish商户官网原文详情:

How to find order information for EU customs declaration (applicable to EU-bound orders shipped from outside of EU)

The below article is part of a series covering EU fulfillment requirements effective July 1, 2021 12:00AM CEST. See here for more information.

To comply with the July 1, 2021 changes to European Union (EU) VAT, merchants shipping EU-bound orders from outside of the EU may be required to share additional order information with shipping carriers as a part of customs declarations (in order to facilitate the completion of necessary customs declarations).

Note that not all merchants shipping to the EU from outside of the EU are required to take additional actions. This article outlines different scenarios and action items applicable to different merchant groups.

1. Shipping to the EU from Mainland China

Merchants shipping EU-bound orders with the Advanced Logistics Program or Smart Logistics Program from Mainland China DO NOT need to take any additional actions described below to meet logistics or customs declaration requirements, as these two programs will cover all the necessary actions for these orders.

On the other hand, drop-ship orders released on or after June 26, 2021 12:00AM CEST (i.e., June 25, 2021 10:00PM UTC) bound for an EU customer address will be marked with a “European Union Order” flag in the Orders > Unfulfilled Orders page and Orders > History page on Merchant Dashboard (or Merchant Plus dashboard’s corresponding Unfulfilled Orders and Order History page) starting July 1, 2021 12:00A CEST, available for merchants to ship with a WishPost 3rd Party Logistics (3PL) channel. When hovering over the flag, merchants will see the following tooltip:

Specifically, when fulfilling EU-bound orders from Mainland China with WishPost 3PL channels, merchants may be subject to the following two scenarios and action items:

If the consignment value of the corresponding product (i.e., customer-paid product price) is less than or equal to €150, no additional action is needed from merchants, as WishPost will take care of relevant logistics and customs declaration requirements.

If the consignment value of the corresponding product is greater than €150, the order will also be marked with an additional "Pay Customer VAT "PC-VAT" required" flag.

To access the order information for customs declaration, click “View details” under the “Action” column of the corresponding order and navigate to the order’s Order details page.

Under the “Product details” section of the Order details page, merchants will find a new section called “EU-bound order information for customs declaration”, which contains all information necessary to file/share with shipping carriers. Merchants may supply the information in this section of the page to the shipping carriers of the above three WishPost logistics channels in any format acceptable by the shipping carriers (electronic submission is strongly preferred/recommended, if this option exists):

Alternatively, merchants may also access this information via v2 and v3 API. Specifically:

V2 API: Merchants may access this information via the newly-added ‘eu_vat_info’ attribute in the response of the following order-related v2 API endpoints

V3 API: Merchants may access this information via the newly-added ‘eu_vat_customs_declaration’ attribute in the response of the following order-related v3 API endpoints:

Retrieve an Order: GET https://merchant.wish.com/api/v2/order

Retrieve Recently Changed Orders: GET https://merchant.wish.com/api/v2/order/multi-get

Retrieve Recently Changed FBW Orders: GET https://merchant.wish.com/api/v2/order/multi-get-fbw

Retrieve Recently Changed FBS Orders: GET https://merchant.wish.com/api/v2/order/multi-get-fbs

Retrieve Unfulfilled Orders: GET https://merchant.wish.com/api/v2/order/get-fulfill

Get an order: GET https://merchant.wish.com/api/v3/orders/%7Bid%7D

List orders: GET https://merchant.wish.com/api/v3/orders

Sunyou European Express Parcel

EQ-Express Parcel-HV-GC

EQ-Expressparcel-HV-SC

Merchants are required to use one of the following three specific WishPost logistics channels that provides Delivered Duty Paid (DDP) service and offers support to remit (at customs) VAT amount collected by Wish and/or customs duties:

As orders with consignment value greater than €150 will require formal customs entry and associated duty payment, it will be up to the merchant, in coordination with the appointed DDP carrier, to determine who should act as the “Importer of Record” for these parcels and how the additional costs will be managed/paid.

Learn more about EU-bound orders flagged as “Pay Customer VAT “PC-VAT” required” here.

Merchants need to file/share additional order information with these carriers as a part of customs declarations.

Specifically, the ‘eu_vat_customs_declaration’ can be located in order → tax_information → vat_information → eu_vat_customs_declaration attribute.

文章内容来源:wish商户官方网站

上一篇:wish物流模板如何设置

下一篇:wish商户包裹怎样顺利清关?