对于先前并未配置税务设置的wish商户,若要使用FBW-EU-AMS仓库,应该如何提供税务信息?

- 对于先前并未配置税务设置的商户

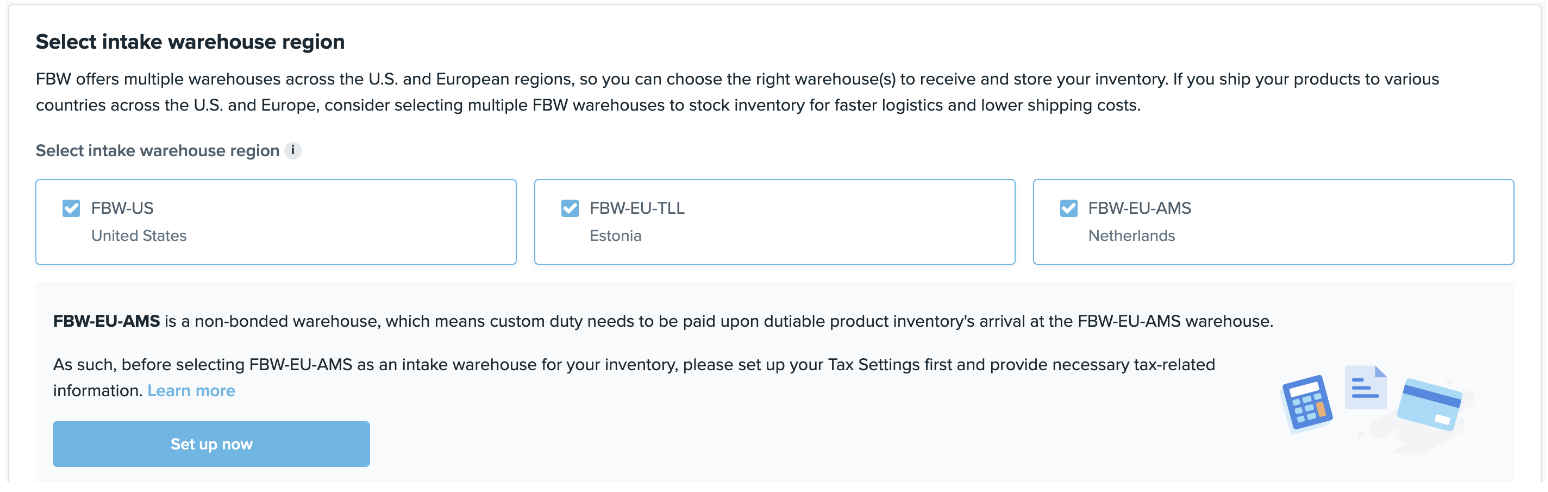

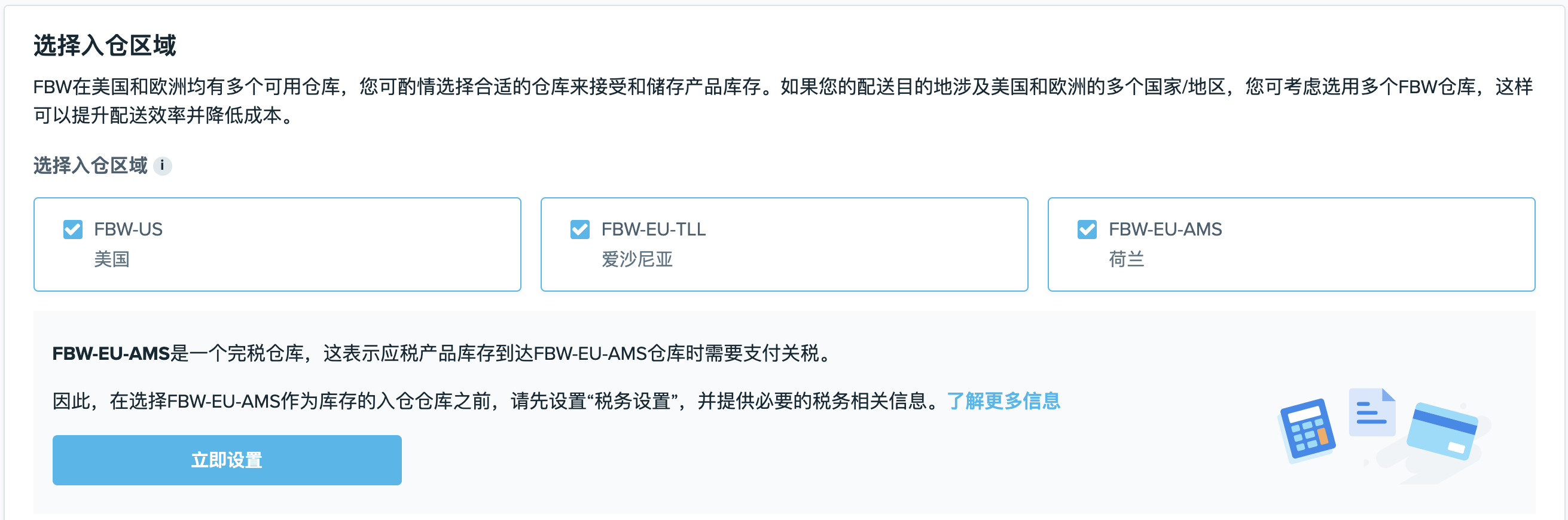

如果您选择 FBW-EU-AMS 作为进货仓库,则“创建配送计划”页面将引导您完成设置流程。

首先,选择 FBW-EU-AMS 作为进货仓库后,系统将提示您设置税务设置:

点击“立即设置”后,您将进入税务设置流程,以便在使用 FBW-EU-AMS 之前提供必要的信息。

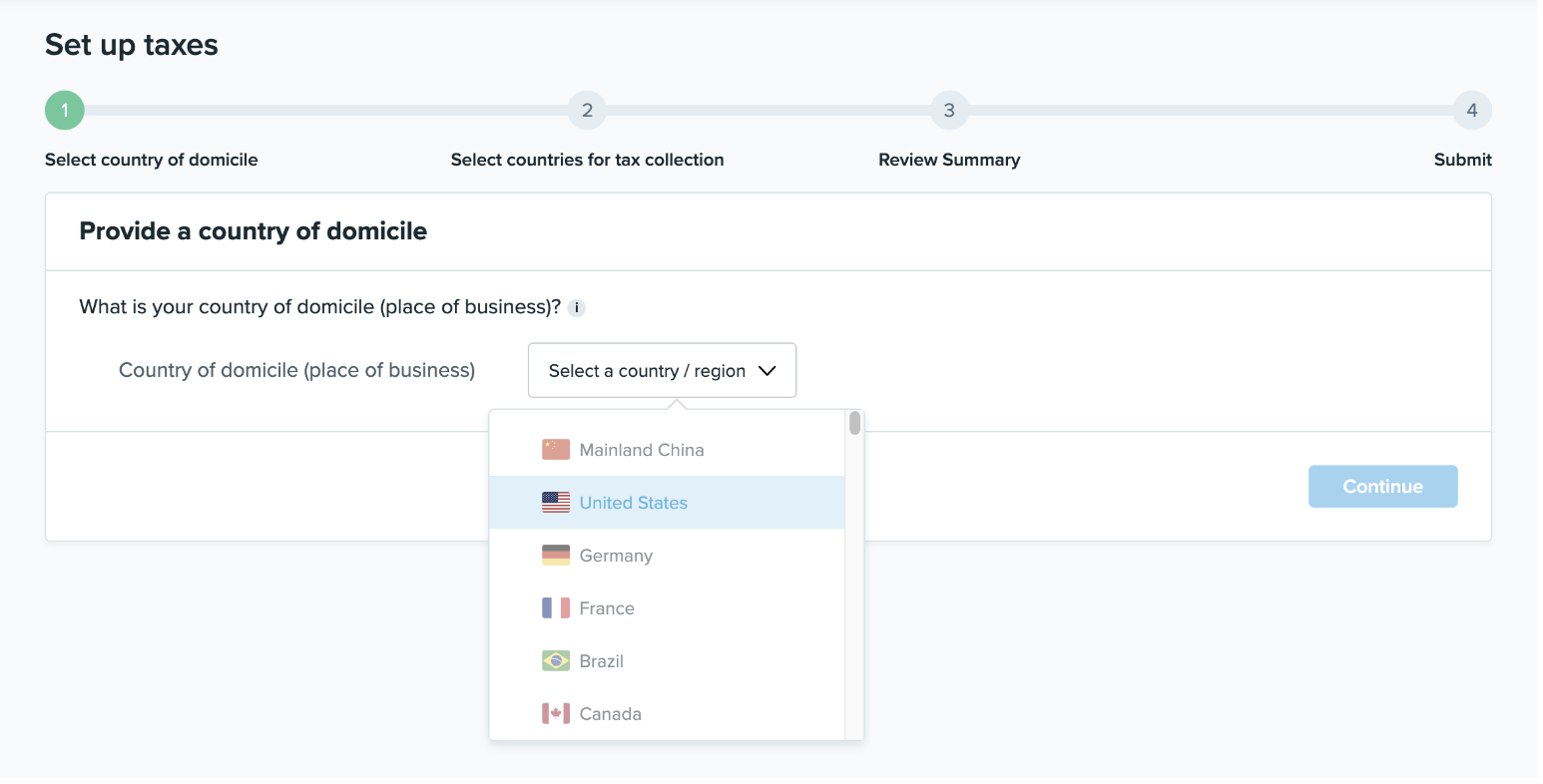

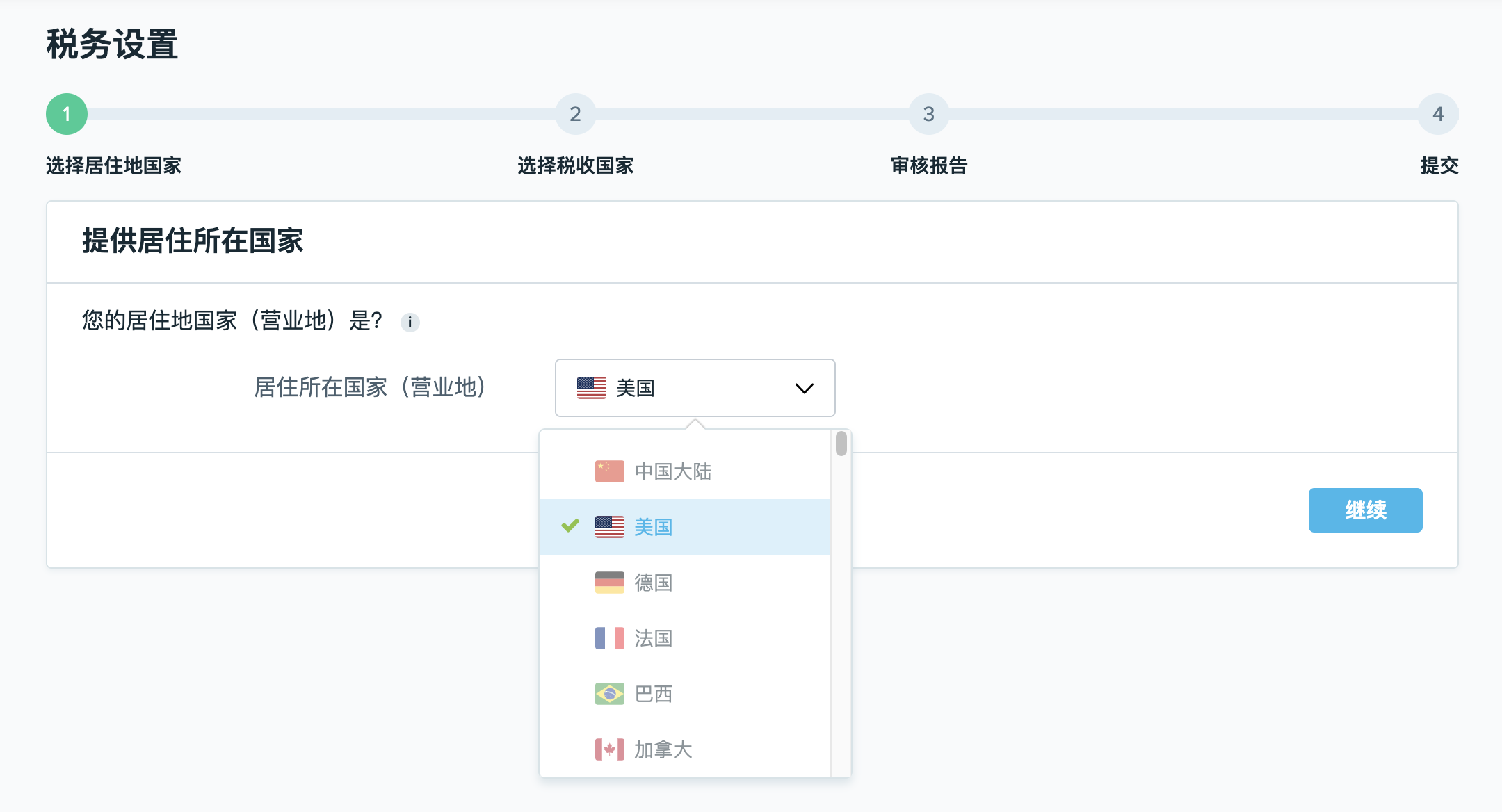

1). 在随后的页面中选择所在地国家/地区(即营业地点),是指公司经营主要业务的地点。在此示例中,wish在下拉菜单中选择美国作为wish商户的所在国家。完成后点击“继续”。

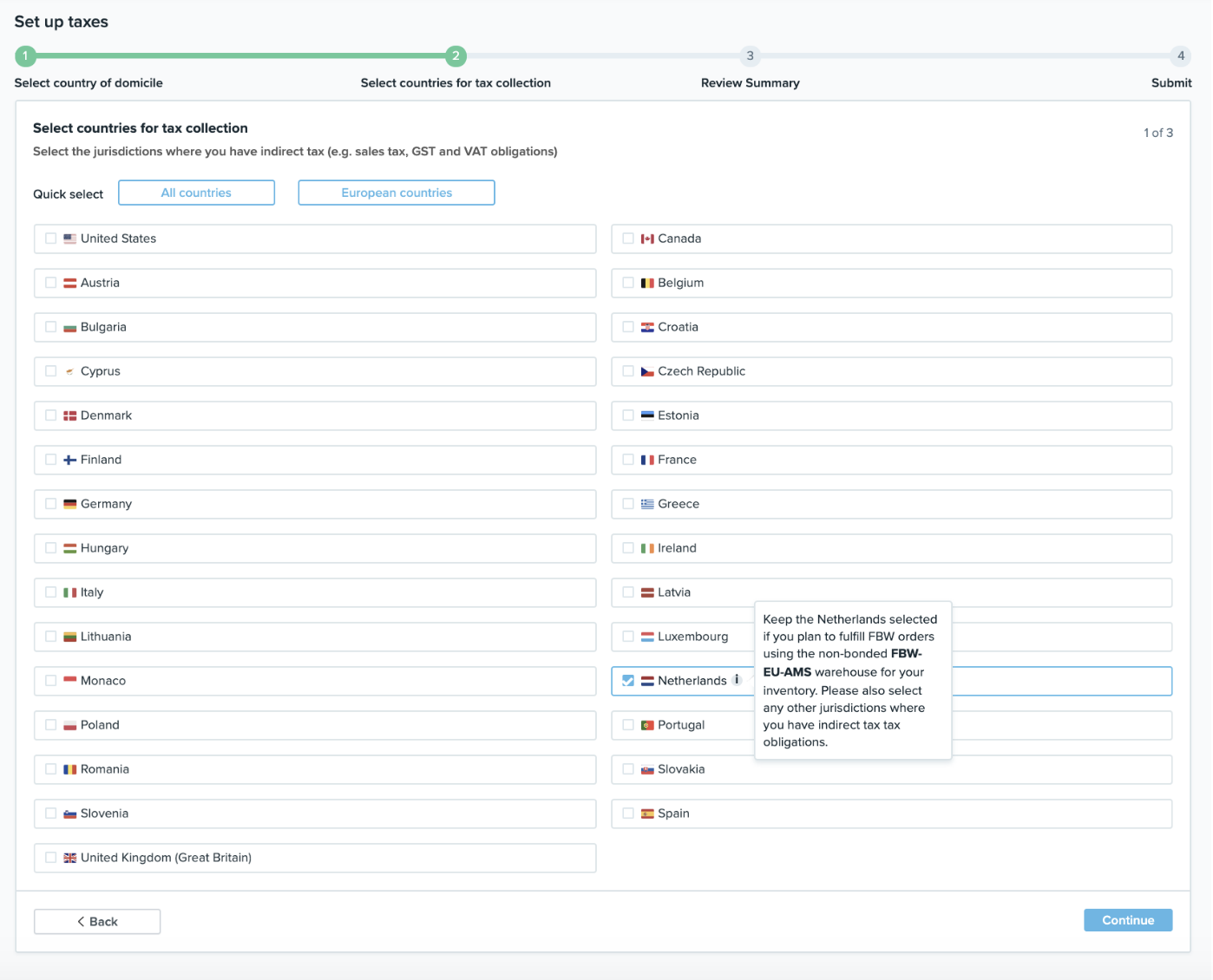

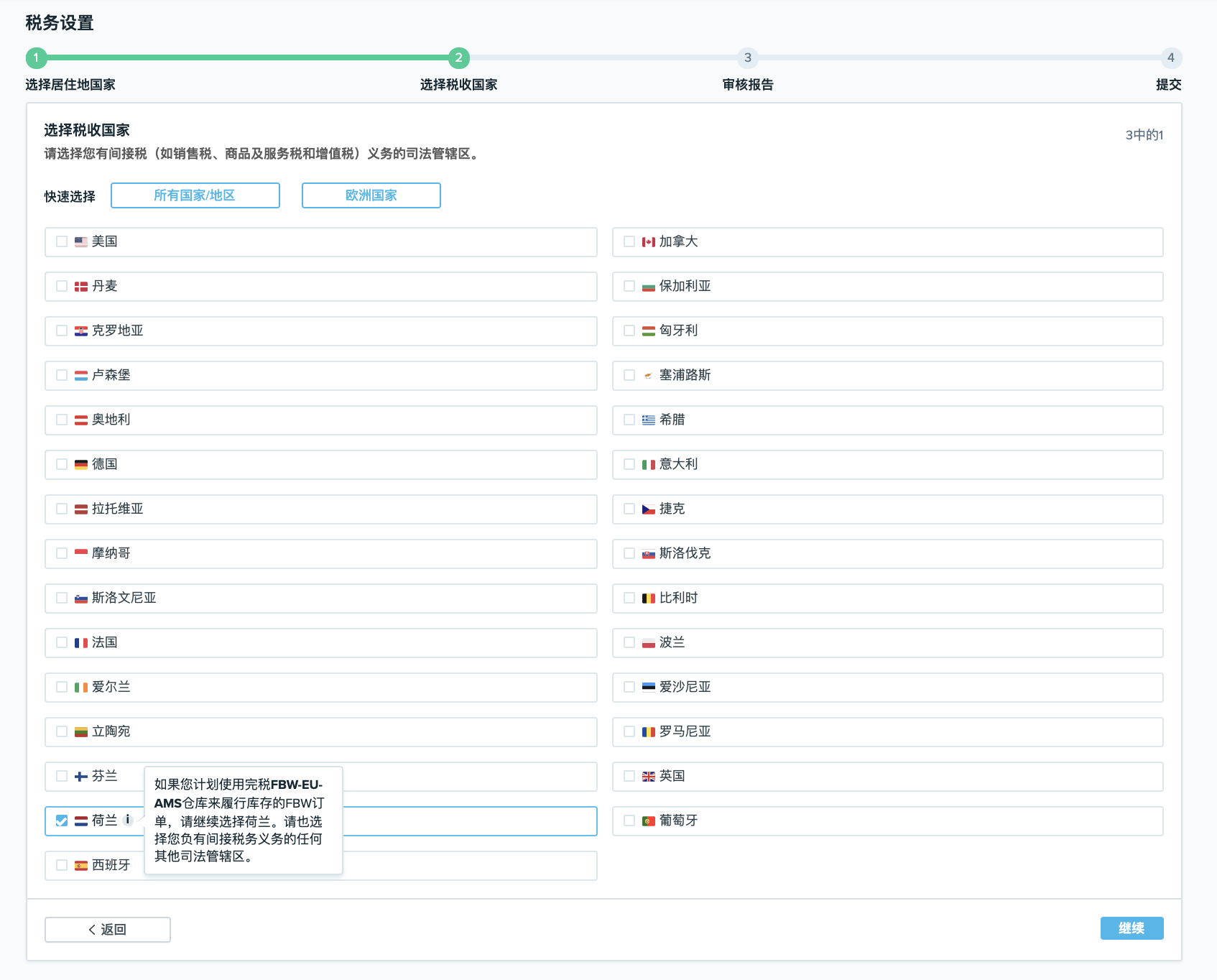

2). 然后,商户可以选择其纳税国家/地区(即他们承担销售税、商品及服务税和增值税等间接税义务的司法管辖区)。因为这里要使用的是 FBW-EU-AMS 仓库,所以系统会在此步骤中自动为商户预先选择“荷兰”(即 FBW-EU-AMS 仓库的所在地):

商户可以根据需要选择其他征税国家/地区。然后点击“继续”以进行下一步操作。

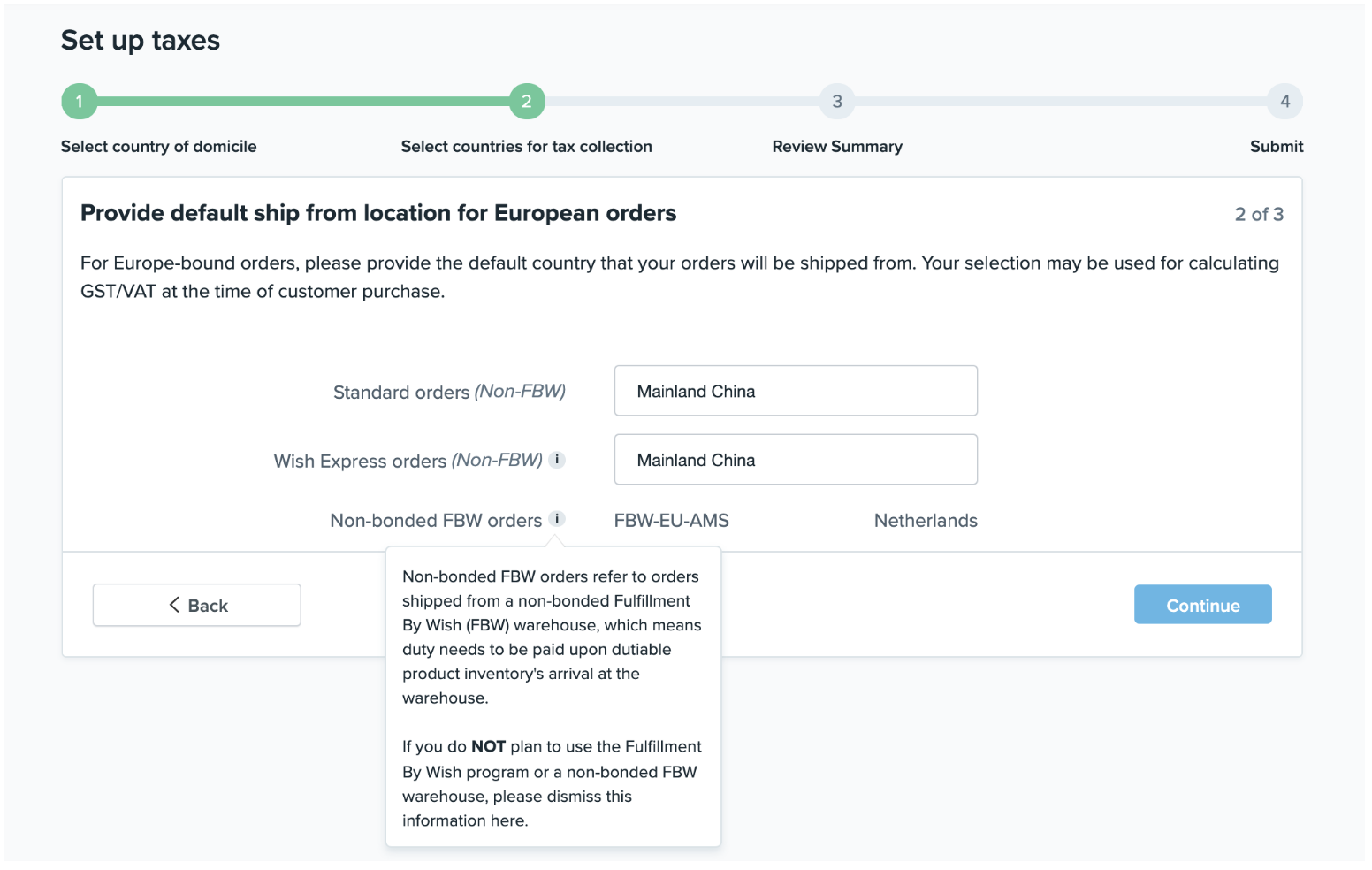

3). 由于选择了一个或多个欧洲的征税国家/地区,系统将要求商户提供欧洲路向标准订单、非 FBW 的 Wish Express 订单和完税仓 FBW 订单的默认发货地点(在此例中,为了使用 FBW-EU-AMS,“完税仓 FBW 订单”发货地国家/地区将默认为荷兰,即完税仓 FBW-EU-AMS 的所在地):

发货地的选择可用于在用户购买产品时计算商品及服务税/增值税。

点击“继续”,转到下一步。

注意:如果商户未在商户平台更新此信息,则平台可能不会向商户显示欧盟的估计税额,或显示的金额可能不正确。

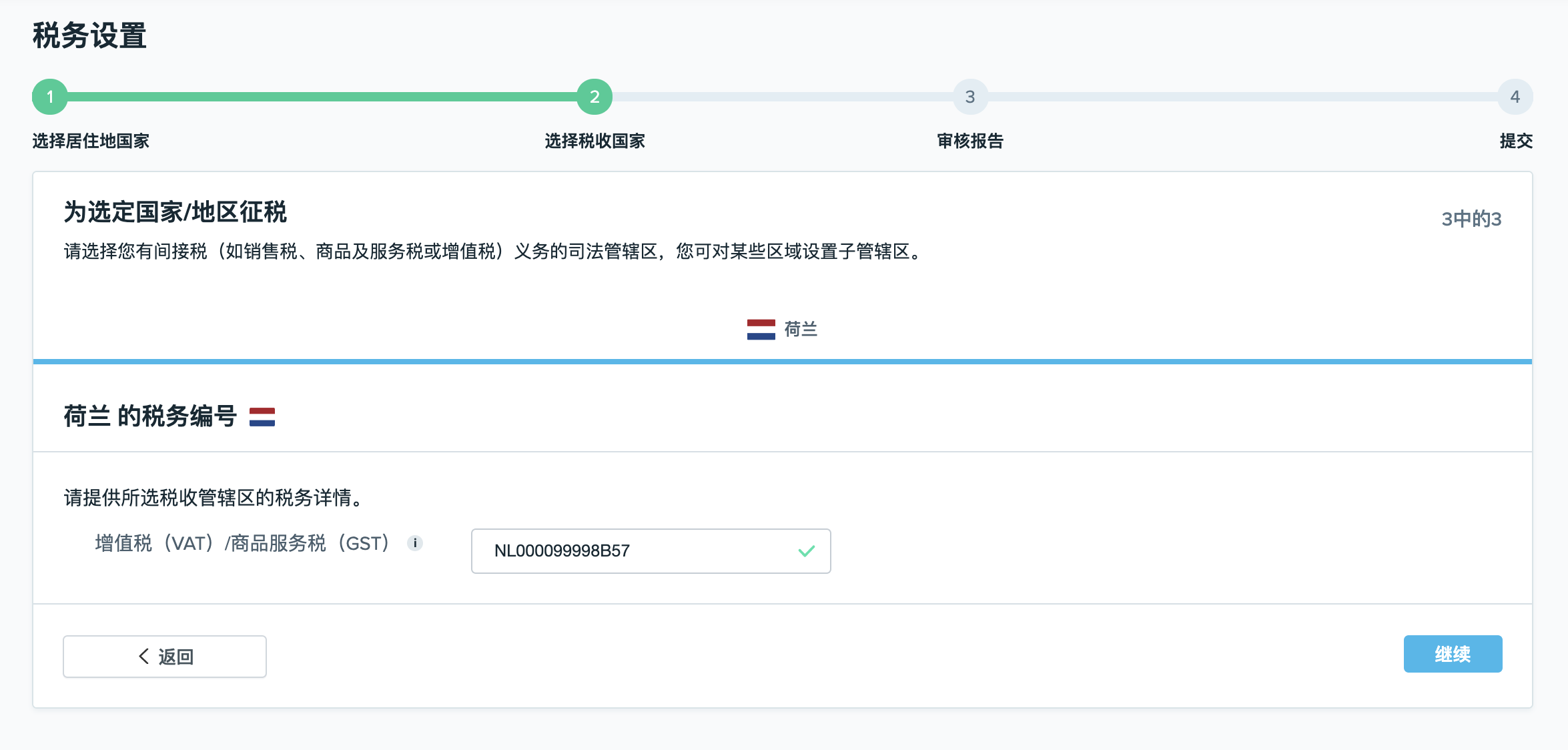

4). 然后,商户需为上文步骤 2) 中选定的所有地区填写税务识别号码 (TIN)。由于选择了荷兰作为征税国家,商户需要输入荷兰税号:

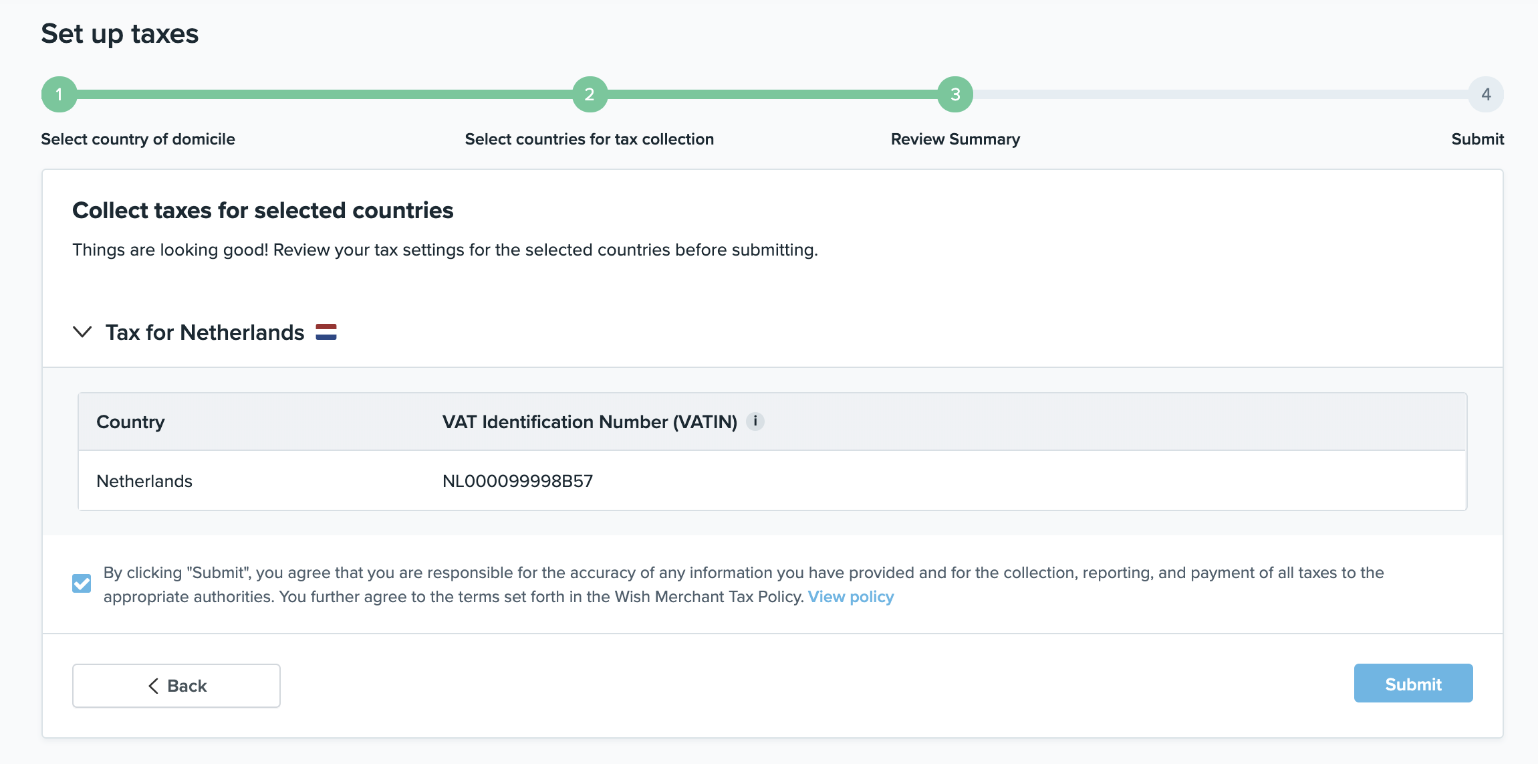

点击“继续”进入下一页,勾选下列复选框并提交:

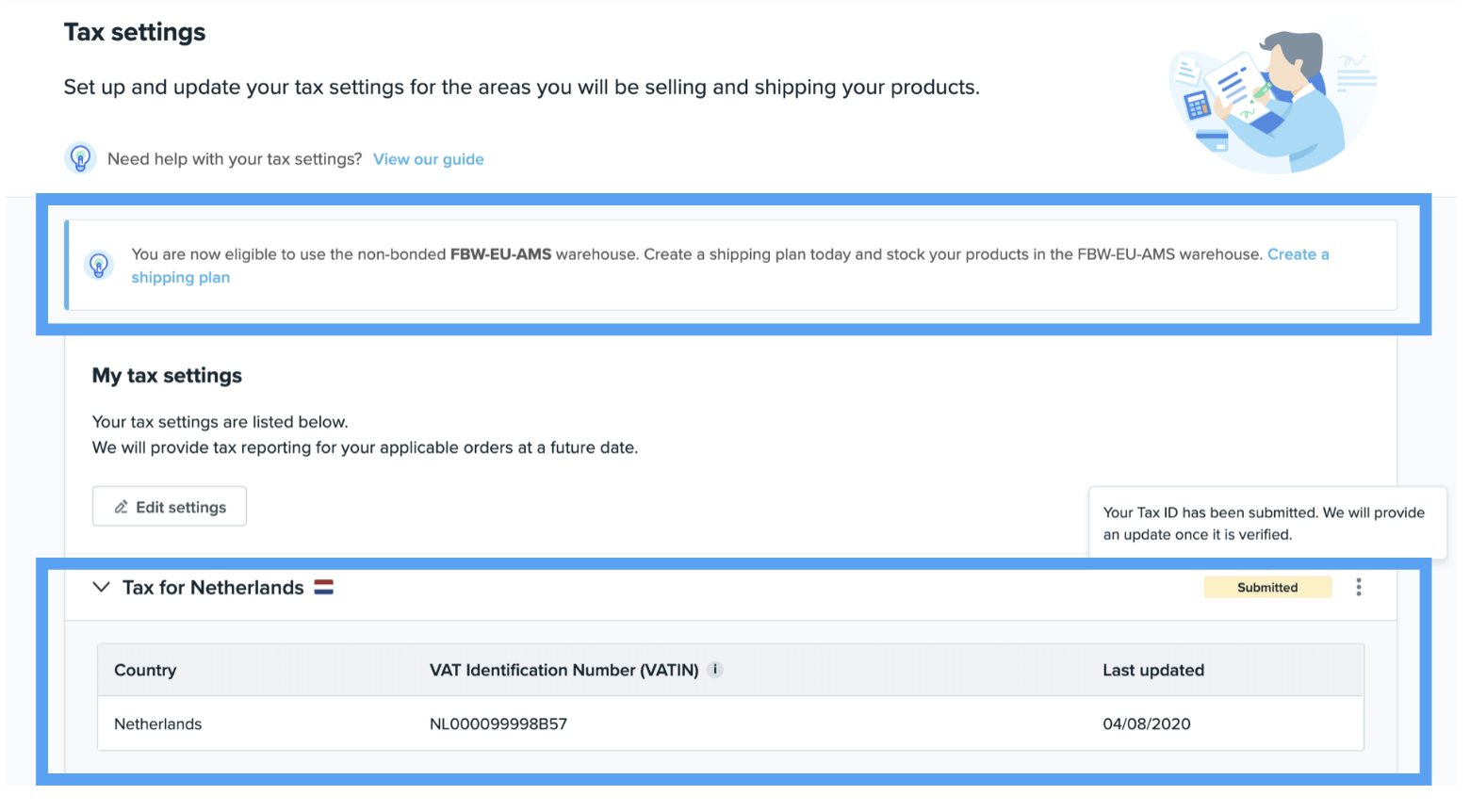

5). 最后,系统会跳转至税务设置主页,此页面显示商户已将荷兰设为征税国家,现在可以创建发往 FBW-EU-AMS 的配送计划:

商户可参阅此篇常见问题解答,了解更多有关启用税务设置的信息。

wish商户官网原文详情:

For merchants who have not previously configured their Tax Settings

The Create Shipping Plan page will walk you through the process of setting it up if you choose FBW-EU-AMS as an intake warehouse.

First, once you select FBW-EU-AMS as an intake warehouse, you will be prompted to set up your Tax Settings:

After clicking “Set up now”, you will be taken to the Tax Settings process to provide the necessary information before accessing FBW-EU-AMS.

1). On the page that follows, select your country of domicile (i.e. place of business), which refers to a place where a company’s principal affairs of the business are maintained. In this example, we select the United States from the drop-down menu as our country of domicile. Click “Continue” when done.

2). Then merchants are able to select their countries for tax collection (i.e. the jurisdictions where they have indirect tax obligations, such as sales tax, GST, and VAT). Because accessing FBW-EU-AMS is the goal here, the Netherlands (where the FBW-EU-AMS is located) will be automatically pre-selected for merchants in this step:

Merchants may choose other countries for tax collection as necessary. Then click “Continue” to move to the next step.

3). Because one or more European countries have been selected as countries for tax collection, merchants will then be asked to provide default ship from location for Europe-bound orders for standard orders, non-FBW Wish Express orders, and non-bonded FBW orders (in this case, for the purpose of accessing FBW-EU-AMS, “Non-bonded FBW orders” ship from country will default to the Netherlands, where the non-bonded warehouse FBW-EU-AMS is located):

The above selection for ship from locations may be used for calculating GST/VAT at the time of customer purchase.

Click “Continue” to move to the next step.

Note: If this information is not updated in the Merchant Dashboard, merchants may not be shown the estimated tax amounts for EU or the amounts shown may be incorrect.

4). Merchants then fill in their Tax Identification Number (TIN) for each region selected in step 2) above. As the Netherlands was selected for tax collection, merchants need to input Tax IDs for the Netherlands:

Click “Continue” to proceed to the next page & check the checkbox below to submit:

5). Lastly, merchants will be redirected to their Tax Settings homepage and shown that they have set up taxes for the Netherlands, and can now create a shipping plan for FBW-EU-AMS:

Merchants may learn more about activating their Tax Settings by visiting this FAQ article.

文章内容来源:wish商户官方网站