若要使用wish平台FBW-EU-AMS仓库,应该如何提供税务信息?

若要使用wish平台FBW-EU-AMS仓库,应该如何提供税务信息?(对于此前已配置税务设置的商户)

由于 FBW-EU-AMS 是非保税仓库,所以商户应在应税产品库存运抵该仓库时缴纳关税。因此,在使用 FBW-EU-AMS 仓库之前,商户需要先在商户平台的 FBW > 创建配送计划页面上提供相关税务信息。

商户可以参阅此常见问题解答,了解有关 FBW EU 的增值税相关信息。

对于此前已配置税务设置的商户

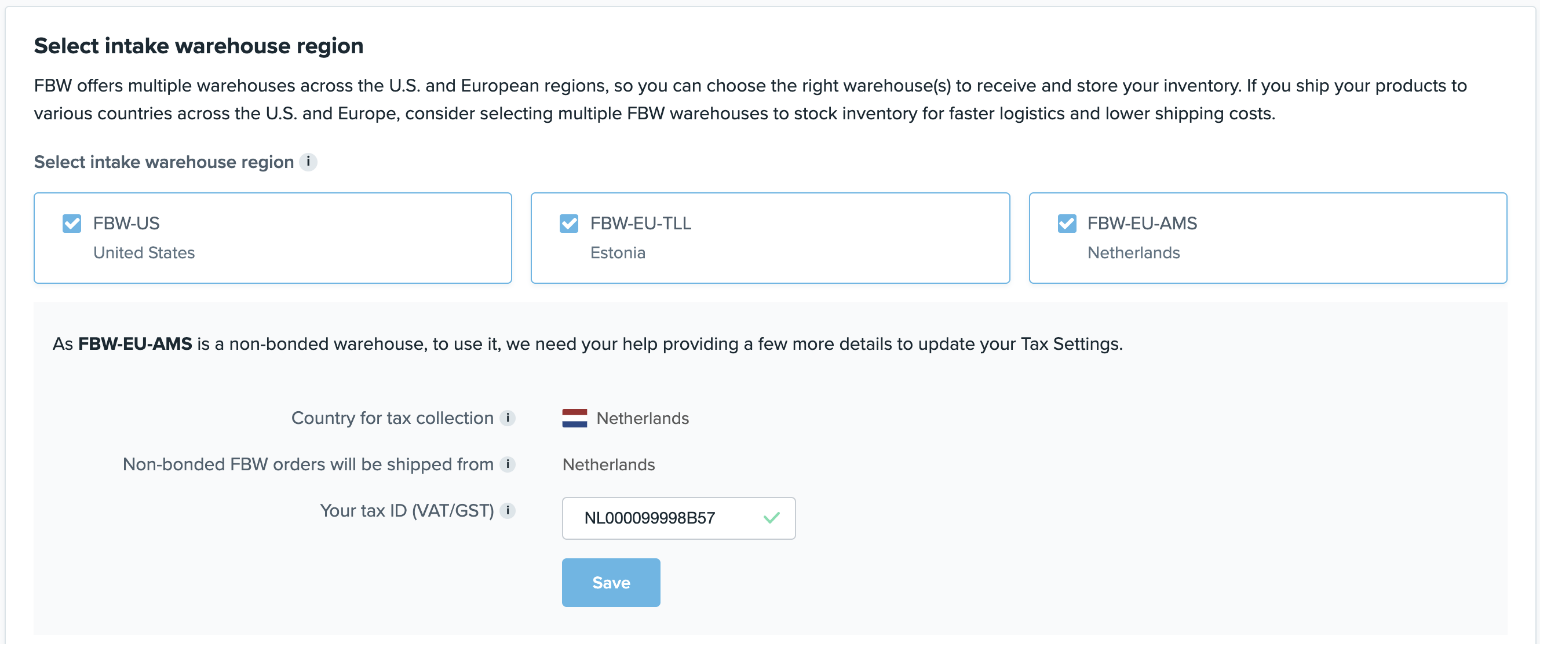

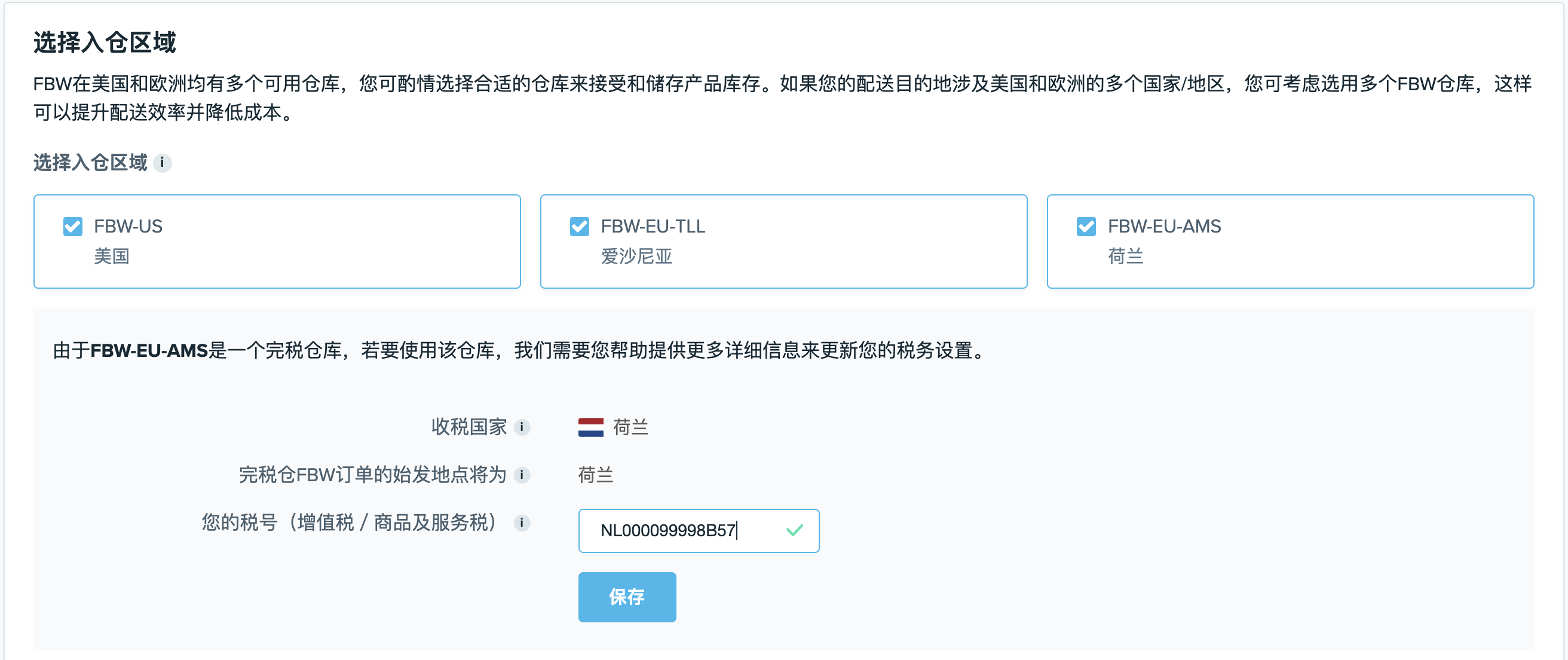

只需在选择 FBW-EU-AMS 作为入库仓库后,直接在“创建配送计划”页面中提供增值税/商品及服务税税号(征税国家为荷兰),即可更新税务设置,如下所示:

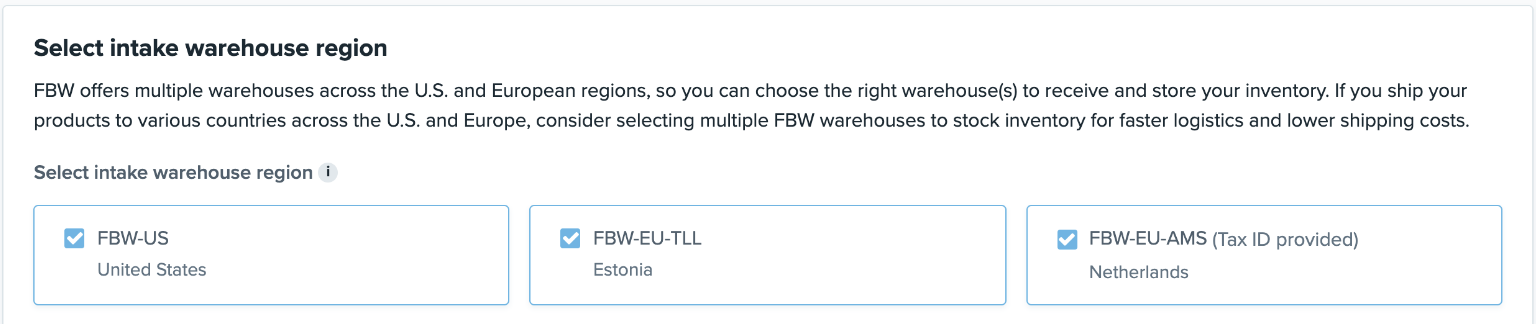

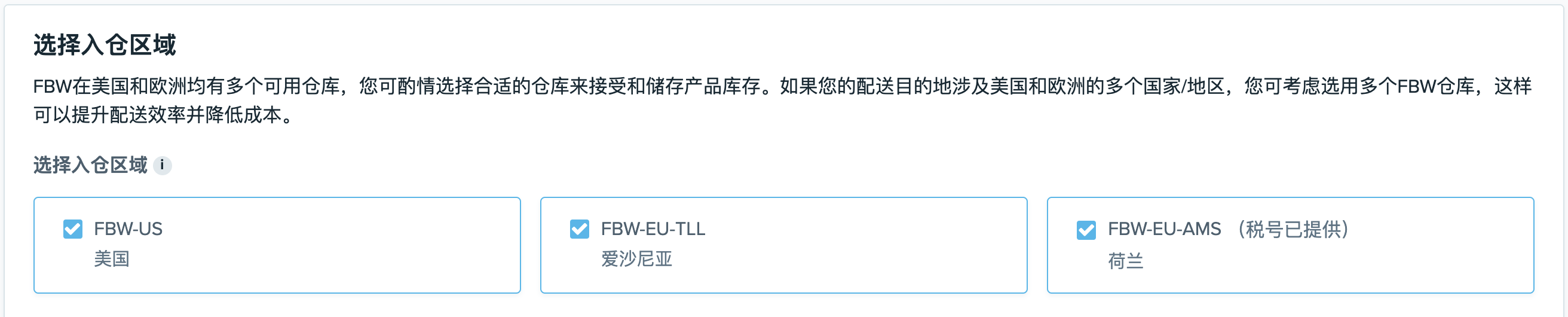

输入正确税号并点击“保存”后,系统会保存您的信息(下图所示页面中的 FBW-EU-AMS 旁将显示“税号已提供”),您将可以开始使用 FBW-EU-AMS:

wish商户官网原文详情:

4. How to provide tax-related information to gain access to FBW-EU-AMS?

Because the FBW-EU-AMS warehouse is a non-bonded warehouse, customs duty needs to be paid upon merchants’ dutiable product inventory’s arrival at the warehouse. Therefore, before gaining access to FBW-EU-AMS, merchants need to first provide certain tax-related information on the FBW > Create a Shipping Plan page in Merchant Dashboard.

Merchants can learn more about VAT-related information relevant to FBW EU by visiting this FAQ.

For merchants who have previously configured their Tax Settings

Simply update your Tax Settings by providing VAT/GST tax ID (country for tax collection is the Netherlands) directly in the “Create a shipping plan” page after you select FBW-EU-AMS as an inbound warehouse, as shown below:

Once you input the correct tax ID and click “Save”, your information will be saved (and FBW-EU-AMS below will show "Tax ID provided"), and you can begin utilizing FBW-EU-AMS:

文章内容来源:wish商户官方网站