如何在wish商户平台上启用和编辑“税务设置”(上)?

请按以下分步指南激活wish平台“税务设置”。

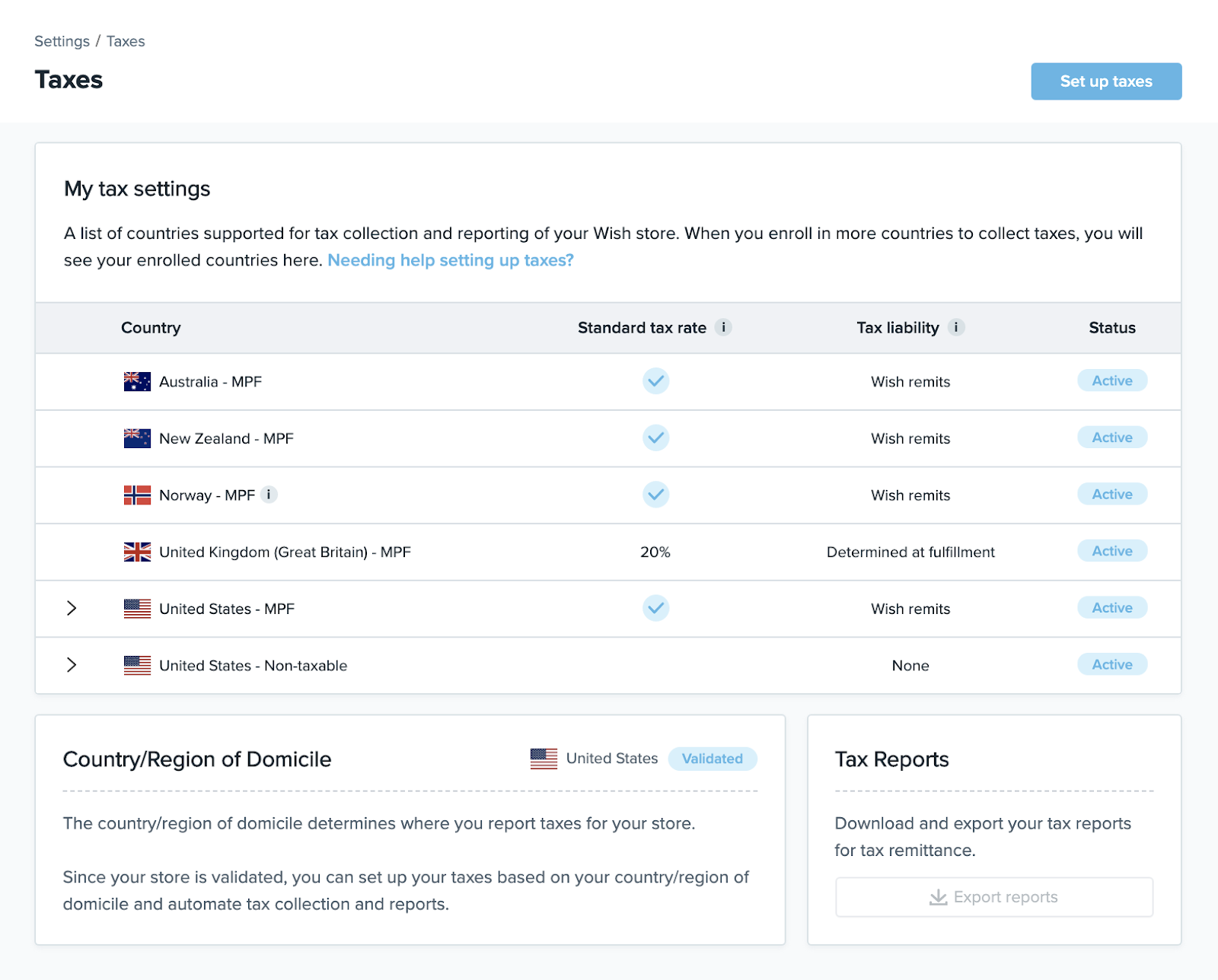

1. 在wish商户平台上,前往“账户”>“税务设置”。点击“立即设置”即可开始:

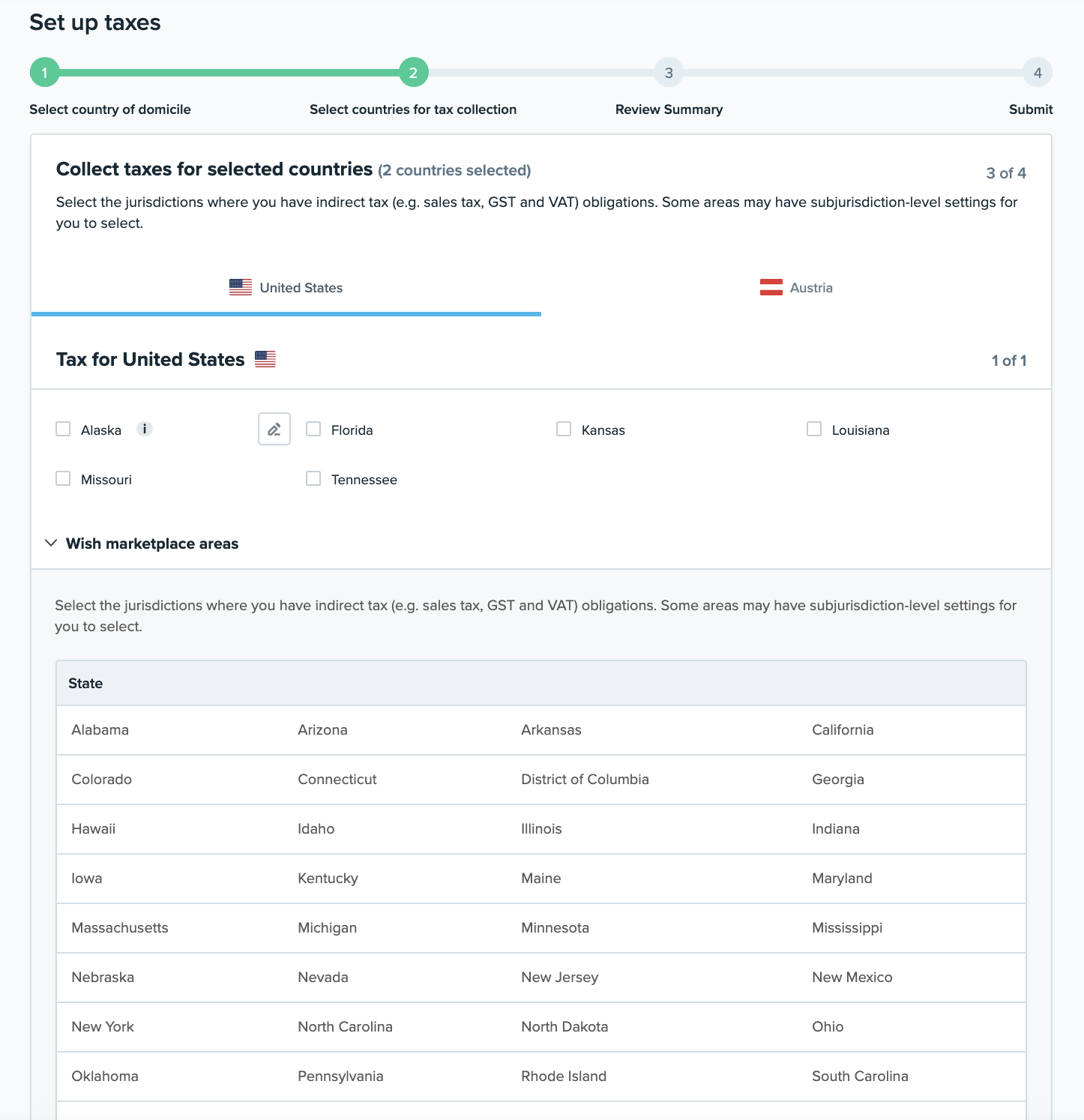

wish“税务设置”主页列出了支持 Wish 店铺代收税款和报税的国家/地区,并概述相关的重要信息。如果您为更多个需要代收税款的国家/地区完成了税务设置,这些国家/地区也会显示在此页中。该页面还提供以下信息:适用于所设置国家/地区的标准税率、纳税义务(Wish 代缴、商户代缴、履行时确定,或无),以及所列特定国家/地区的“税务设置”状态。借助此信息,商户可了解当前的“税务设置”概况。

如需为更多国家/地区进行税务设置,点击“税务设置”即可开始。

请注意,如果您之前尚未验证您的店铺,则需先点击“验证店铺”,通过验证后方可进行税务设置。如需了解更多有关如何验证店铺的信息,请阅读这篇常见问题解答文章。

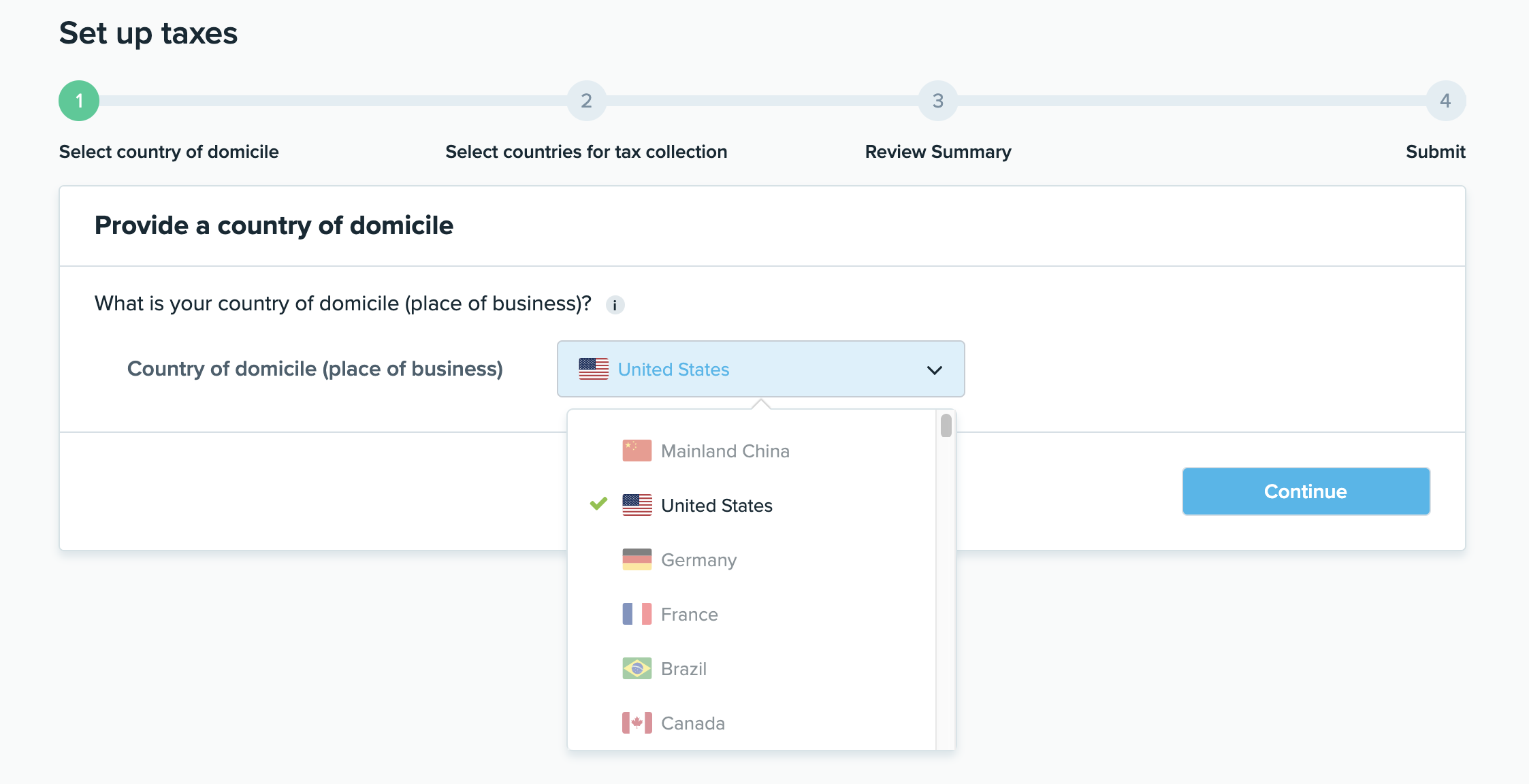

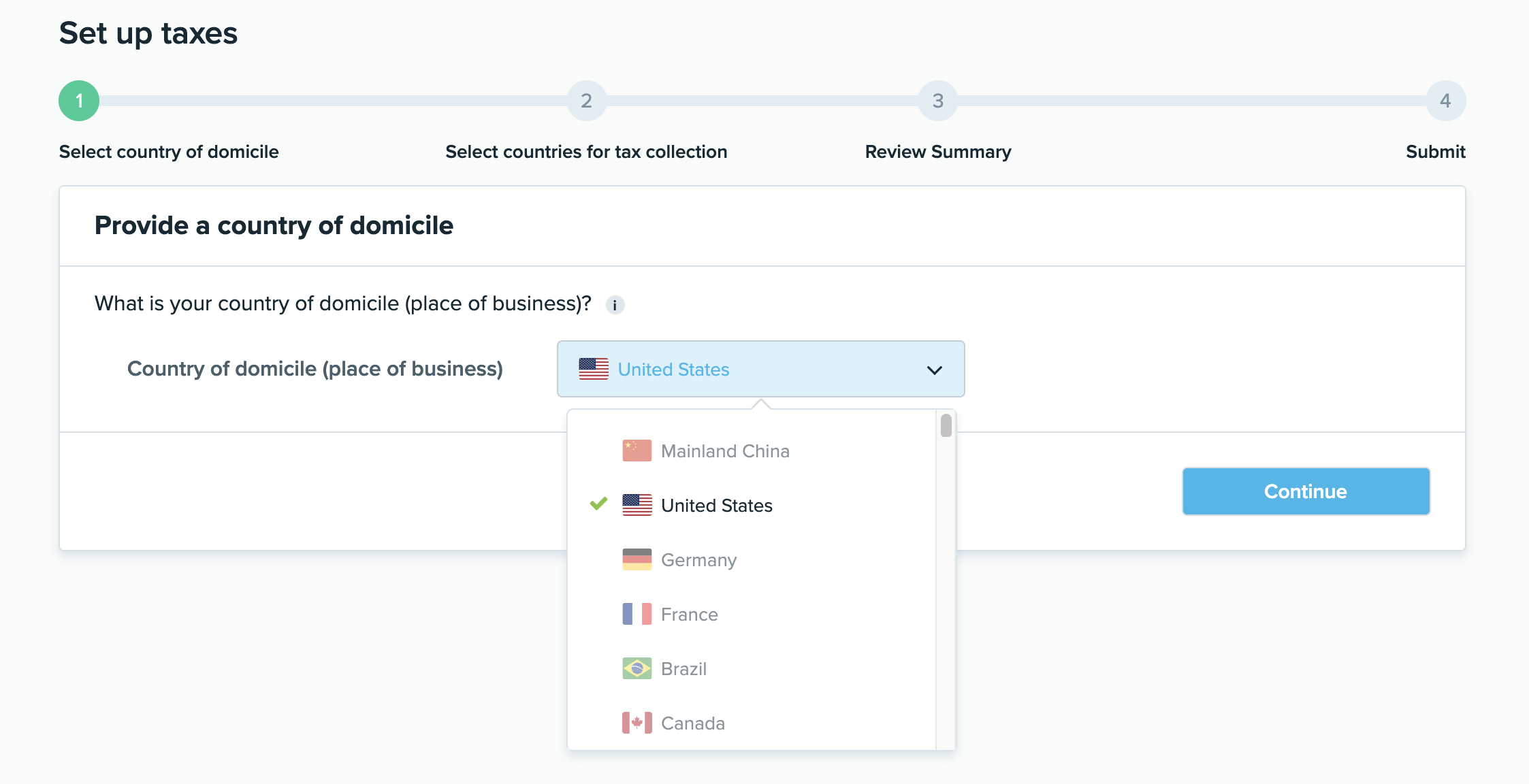

2. 接下来,选择您的所在地国家/地区(即营业地点),是指公司经营主要业务的地点。在此例中,wish在下拉菜单中选择美国作为所在国家。完成后点击“继续”。

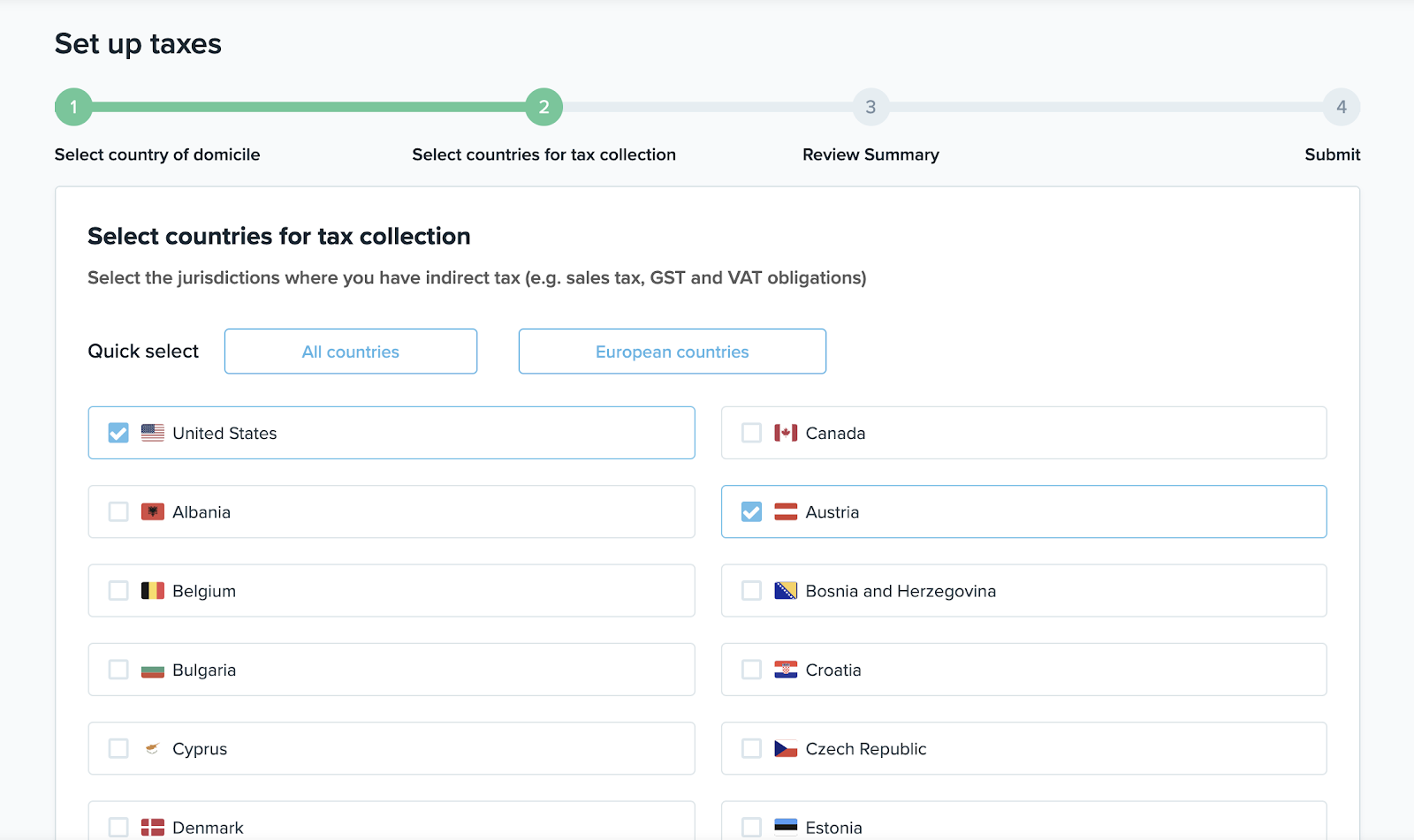

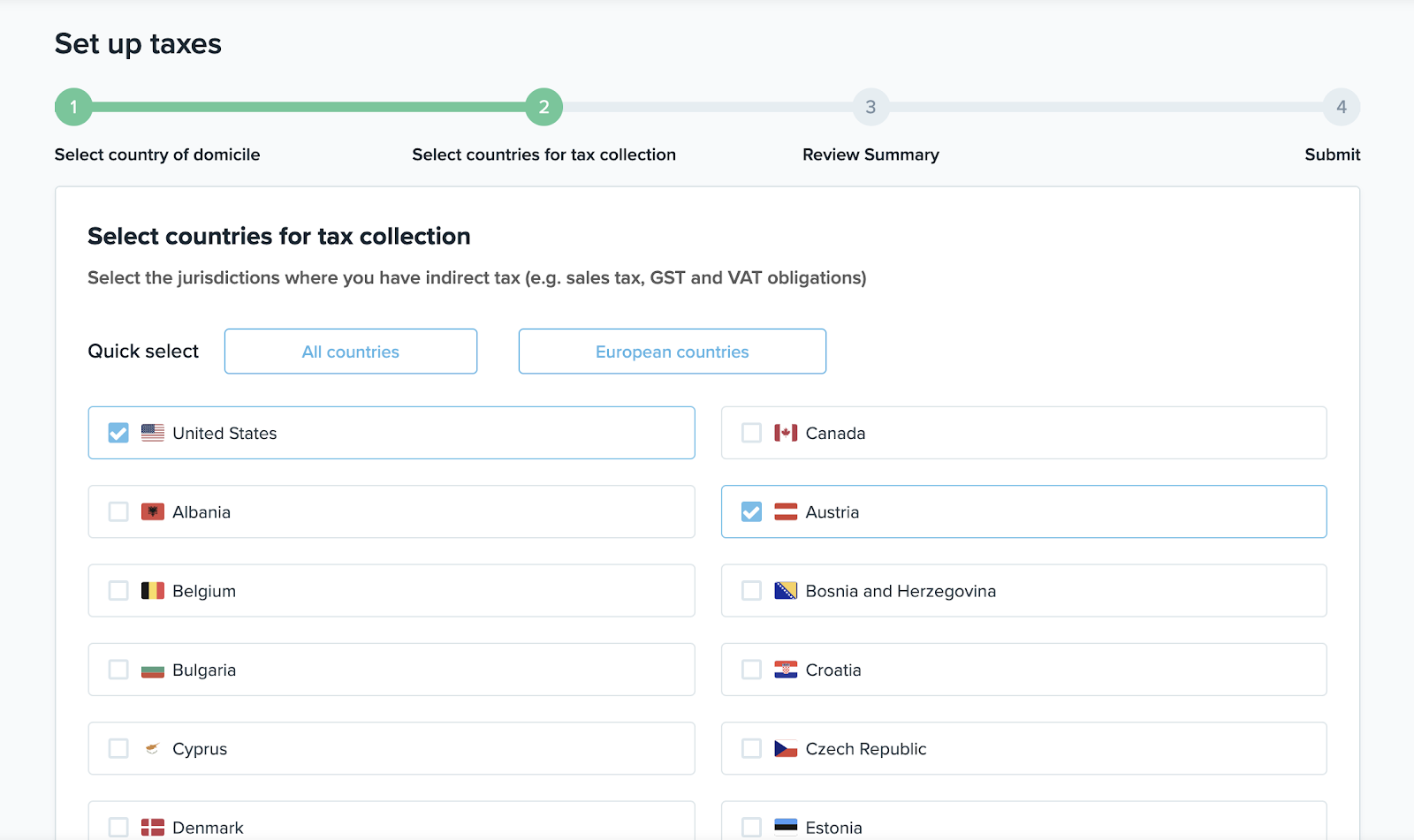

3. 然后,商户可以选择其征税国家。在此例中,wish选择美国和奥地利作为征税国家:

点击“继续”,转到下一步。

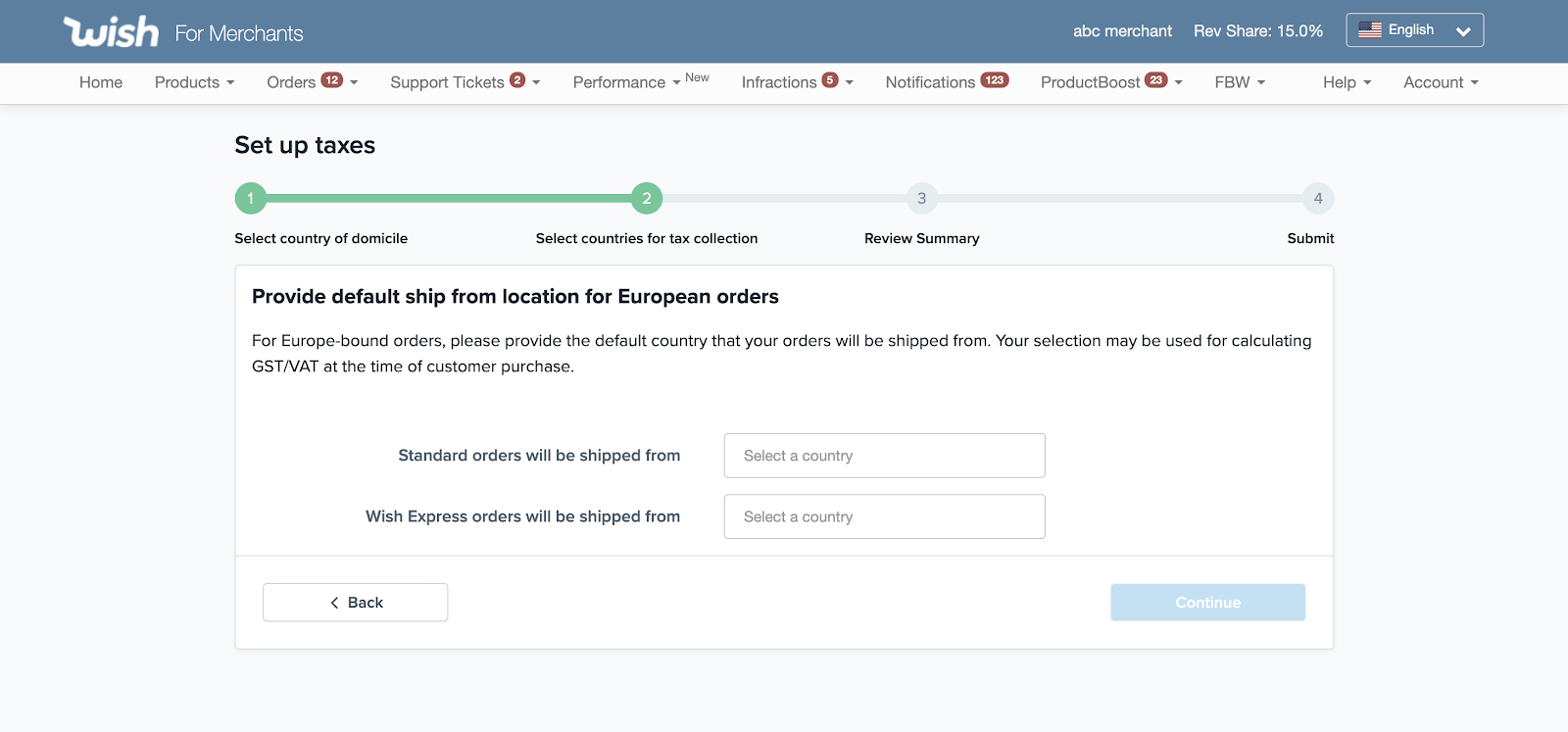

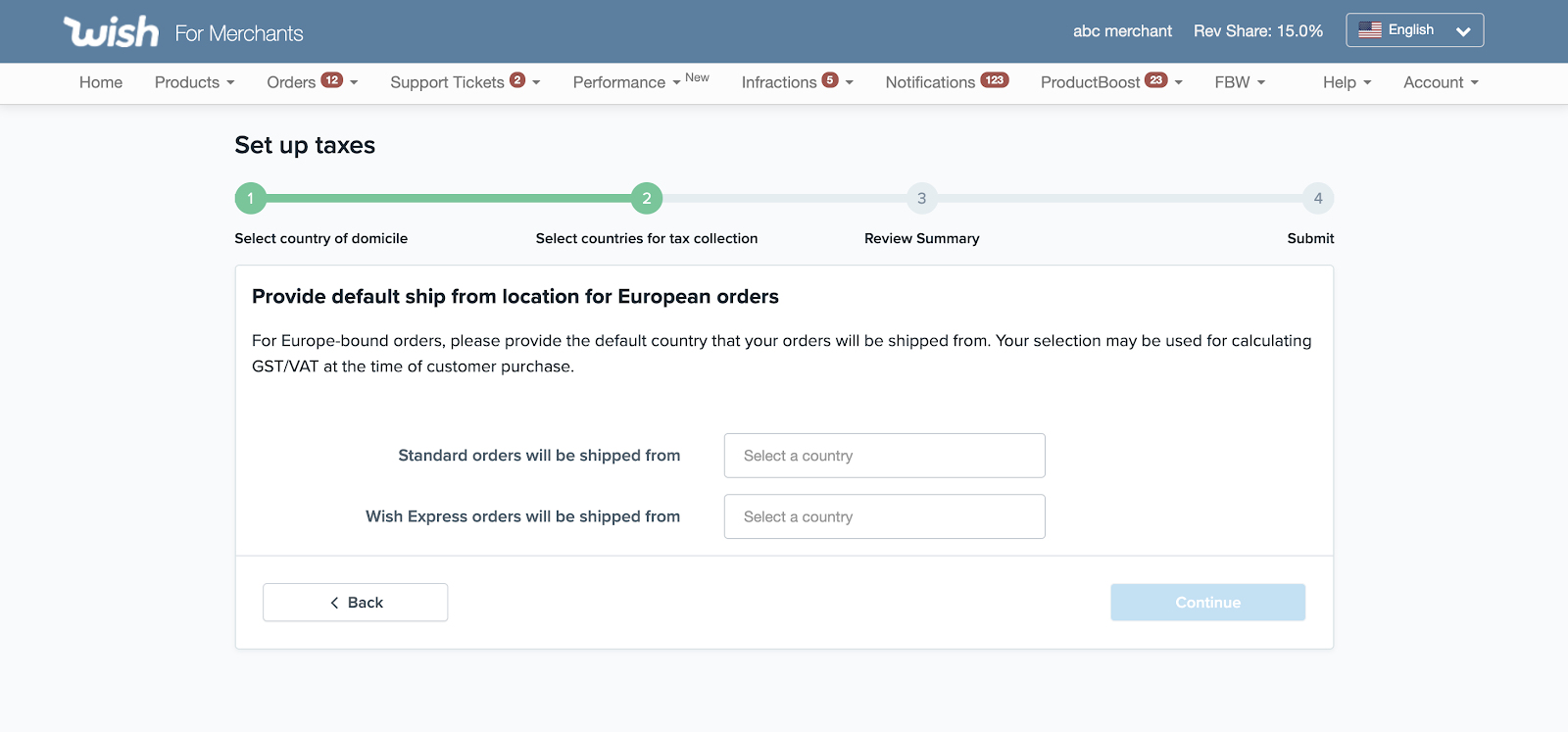

4. 由于选择了一个或多个欧洲国家(在此示例中为奥地利)作为征税国家,因此将要求商户为欧洲路向的标准订单和 Wish Express 订单提供默认发货地。系统会基于您选择的征税国家计算用户购买产品的 GST/VAT。点击“继续”以转到下一步。*请注意:如果wish商户平台未更新此信息,则可能不会显示欧洲国家/地区的估计税额,或显示的金额可能不正确。*

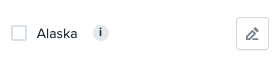

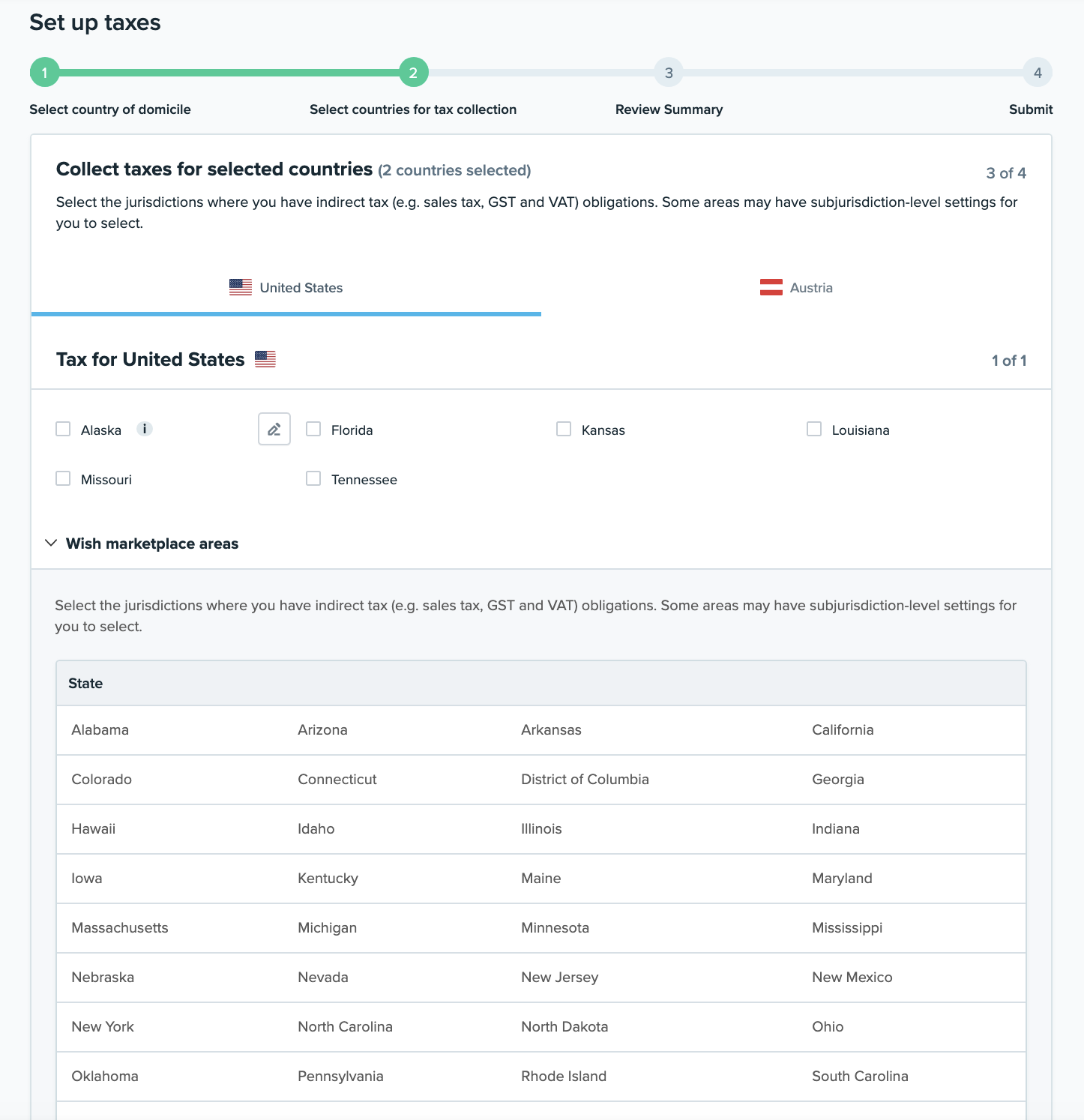

5. 在下一页中,商户需要选择其有间接税(如销售税、GST 和 VAT)义务的司法管辖区。

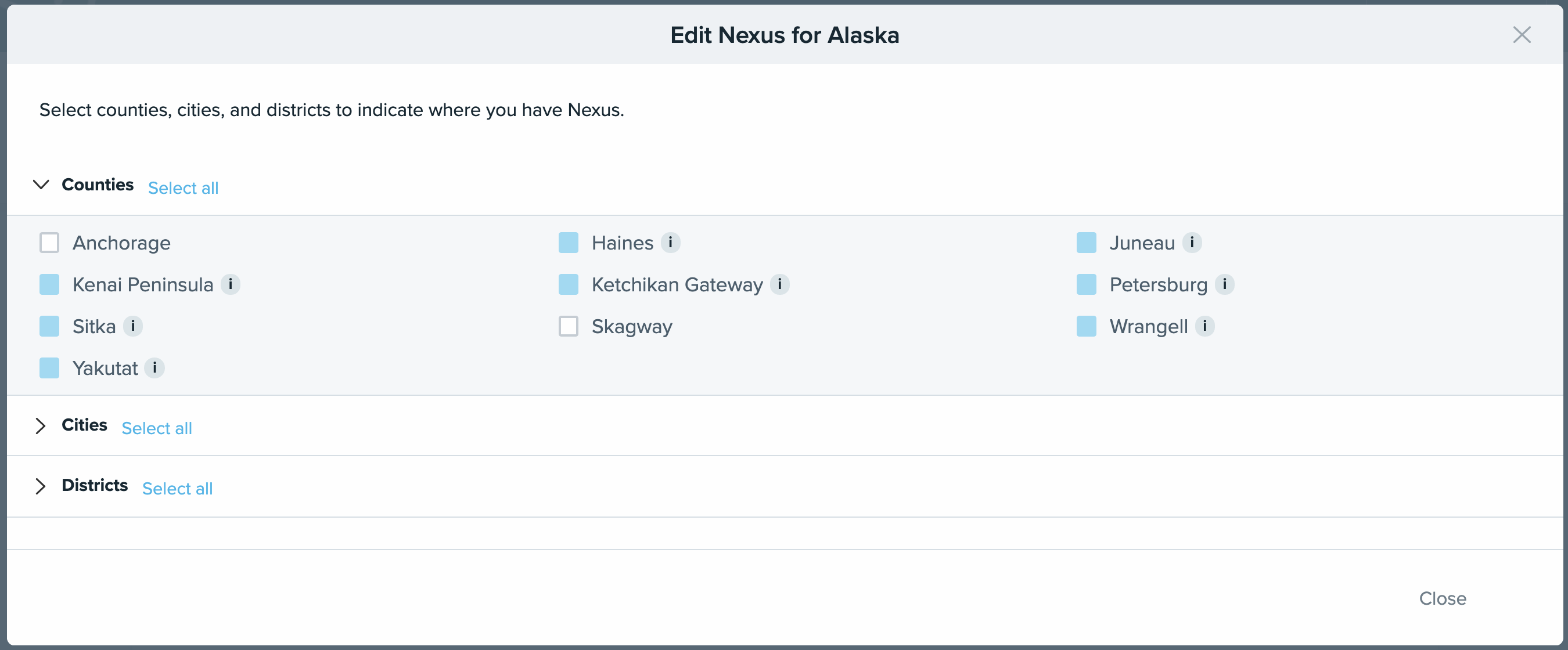

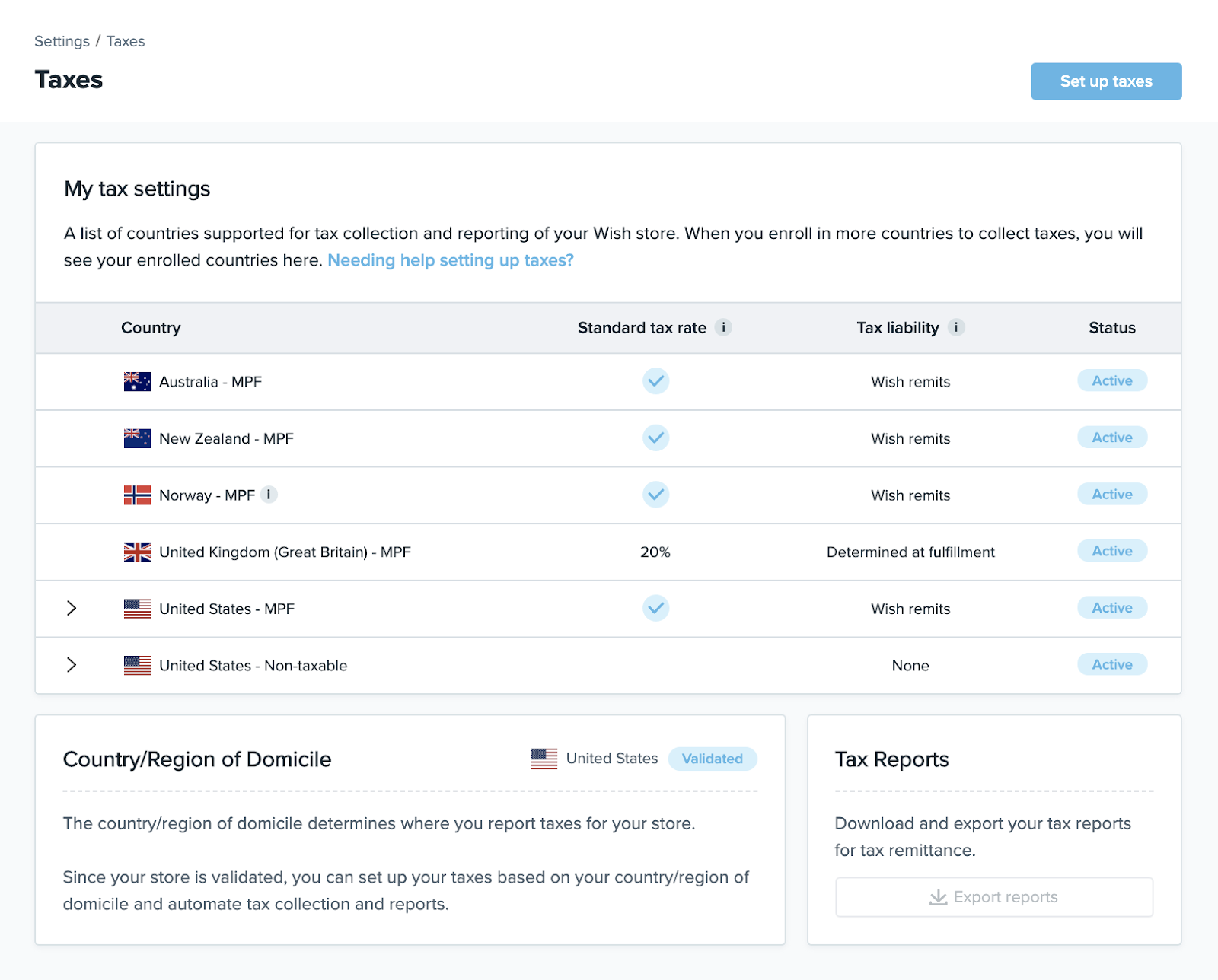

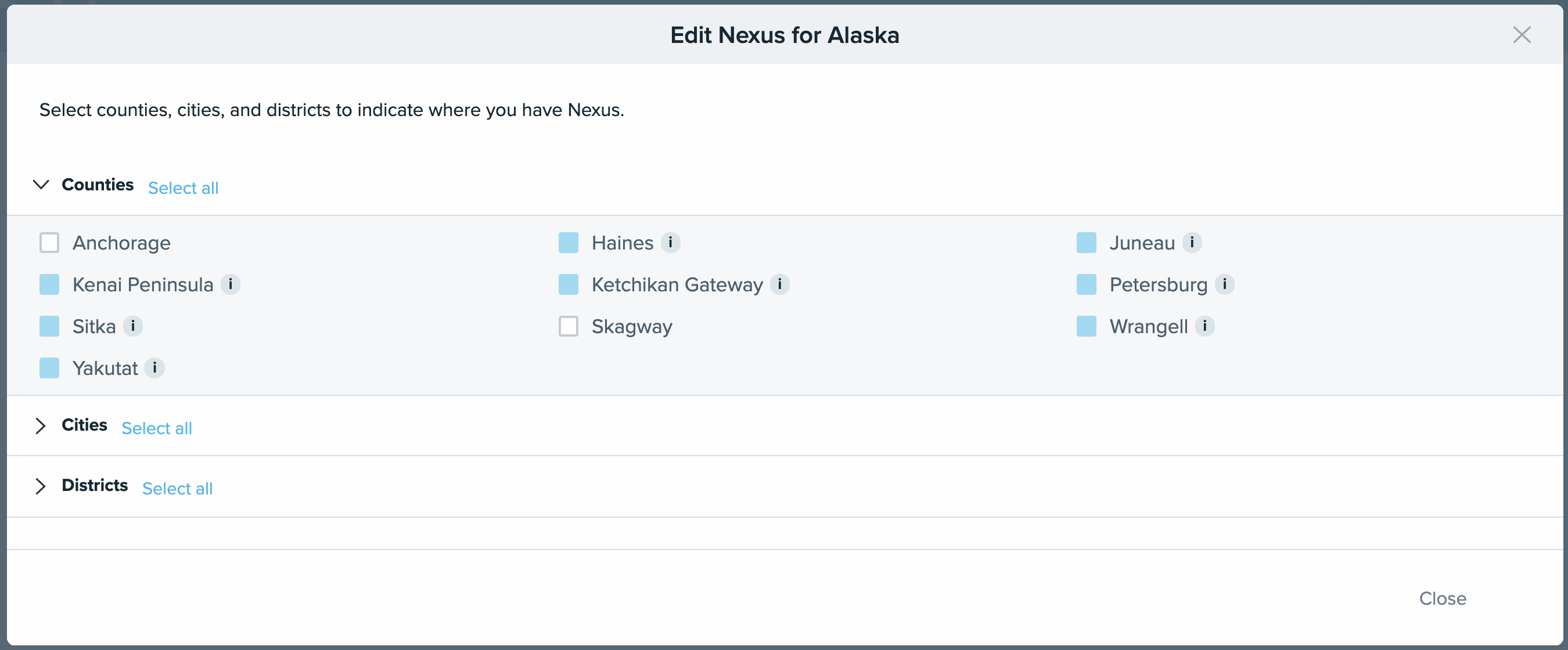

请注意,某些地区可选择子管辖区。以阿拉斯加州为例,商户可以点击铅笔图标来编辑阿拉斯加州某些县、市和地区的税收关联(请注意,阿拉斯加州不征收州税,因此商户可以点击阿拉斯加州旁边的铅笔图标,直接登记州辖下的各司法管辖区的税务信息):

wish商户官网原文详情:

To activate Tax Settings, follow the step-by-step guide below.

1. On the Merchant Dashboard, navigate to Account > Tax Settings on Merchant Dashboard. Click “Set up taxes” to start:

The Tax Settings homepage outlines important information of a list of countries/regions supported by this functionality for tax collection and reporting of your Wish store. When you set up taxes in more countries/regions for tax collection, you will see them listed on this page as well. The list also provides information on standard tax rates applicable to the countries/regions set up, tax liability (Wish remits, merchant remits, Determined at fulfillment, or None), and the status of the Tax Settings for the specific country/region listed. This information provides merchants with an overview of your current Tax Settings.

To set up taxes for more countries/regions, click “Set up taxes” to start.

Note that if you have not previously validated your store, you must click “Validate my store” first before you can set up Tax Settings. To learn more about how to validate your store, please visit this FAQ article.

2. Next, select your country of domicile (i.e. place of business), which refers to a place where a company’s principal affairs of business are maintained. In this example, we select the United States from the drop-down menu as our country of domicile. Click “Continue” when done.

3. Then merchants are able to select their countries for tax collection. In this example, we select the United States and Austria as countries for tax collection:

Click “Continue” to move to the next step.

4. Because one or more European countries (in this example, Austria) have been selected as countries for tax collection, merchants will then be asked to provide default ship from location for Europe-bound orders for both Standard orders as well as Wish Express orders. The selection may be used for calculating GST/VAT at the time of customer purchase. Click “Continue” to move to the next step. *Note: If this information is not updated in the merchant dashboard, merchants may not be shown the estimated tax amounts for EU or the amounts shown may be incorrect.*

5. In the next page, merchants are asked to select the jurisdictions where they have indirect tax (e.g. sales tax, GST and VAT) obligations.

Note that some areas may have subjurisdiction-level settings for merchants to select. For example, in Alaska, merchants have the ability to edit Nexus in certain counties, cities, and districts within the state of Alaska by clicking on the pencil icon (note that for Alaska, there is no state-wide tax, so merchants can click on the pencil icon next to Alaska to directly register for state-administered jurisdictions):

文章内容来源:wish商户官方网站

上一篇:Wish平台知识产权规则

下一篇:wish商户平台“税务设置”介绍