如何通过wish商户平台完成欧盟增值税问卷?

有关如何通过商户平台完成欧盟增值税问卷的详细说明,请参阅下文(有关通过 Merchant Plus 平台访问该问卷的详细信息,请参阅本文末尾的说明):

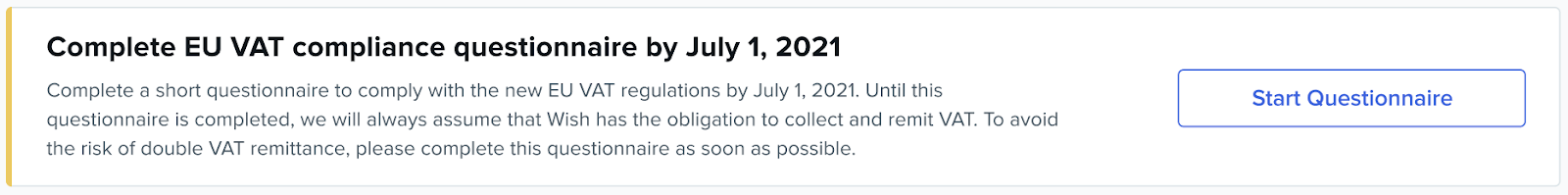

1. 对于已经在账户 > 配送设置页面开通部分或所有欧盟国家/地区的非欧盟本土商户,可登录商户平台主页,在“代办项”部分点击“开始填写问卷”,即可访问“欧盟增值税问卷”。相关商户也会收到电子邮件通知,提醒其完成问卷。

此外,任何非欧盟本土商户若在账户 > 配送设置页面开通欧盟目的国/地区,点击“应用于现有非促销产品”后都会看到完成问卷的提示。请注意,在完成问卷之前,系统将不允许商户在“配送设置”页面开通新的欧盟国家/地区。

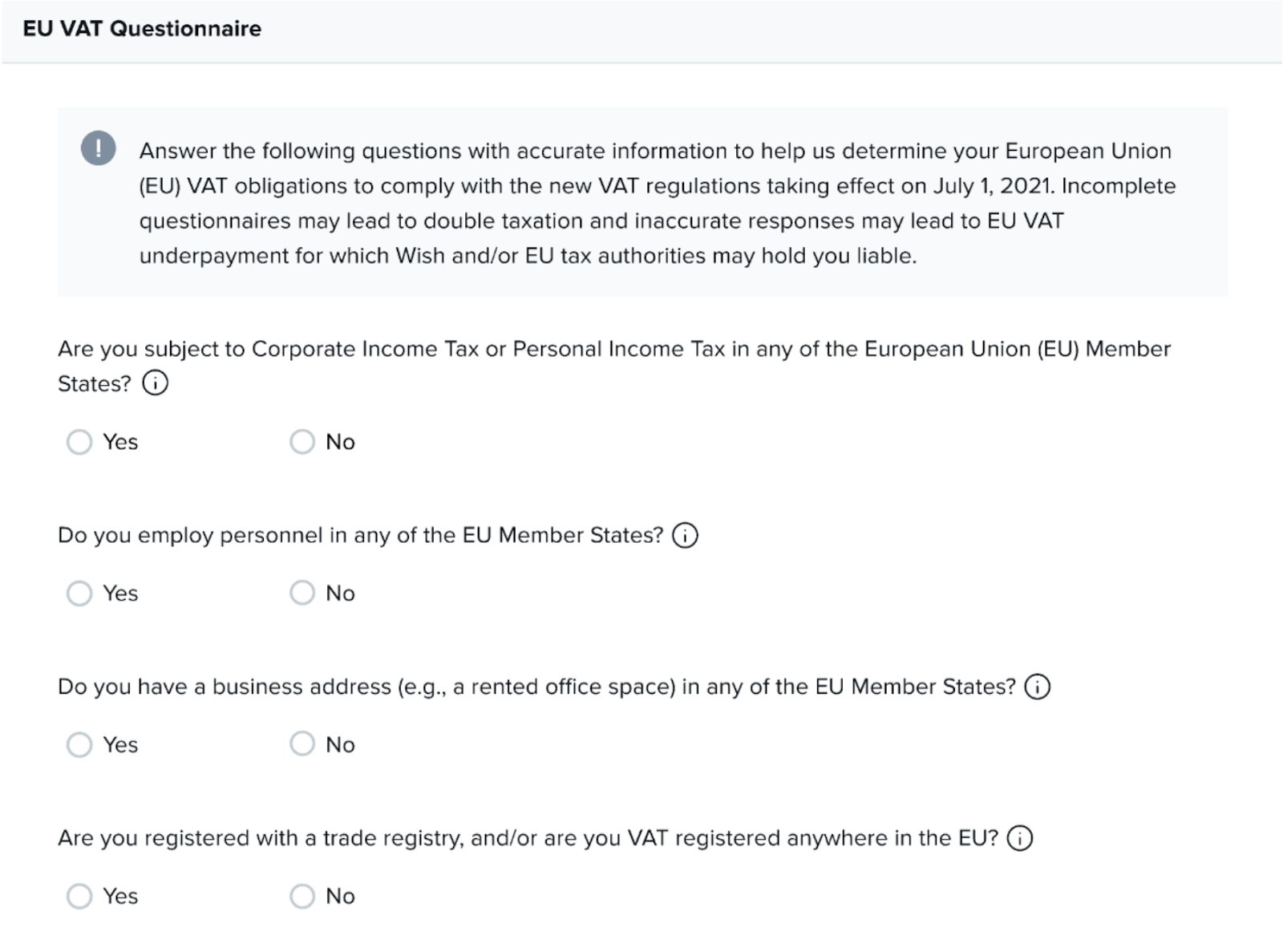

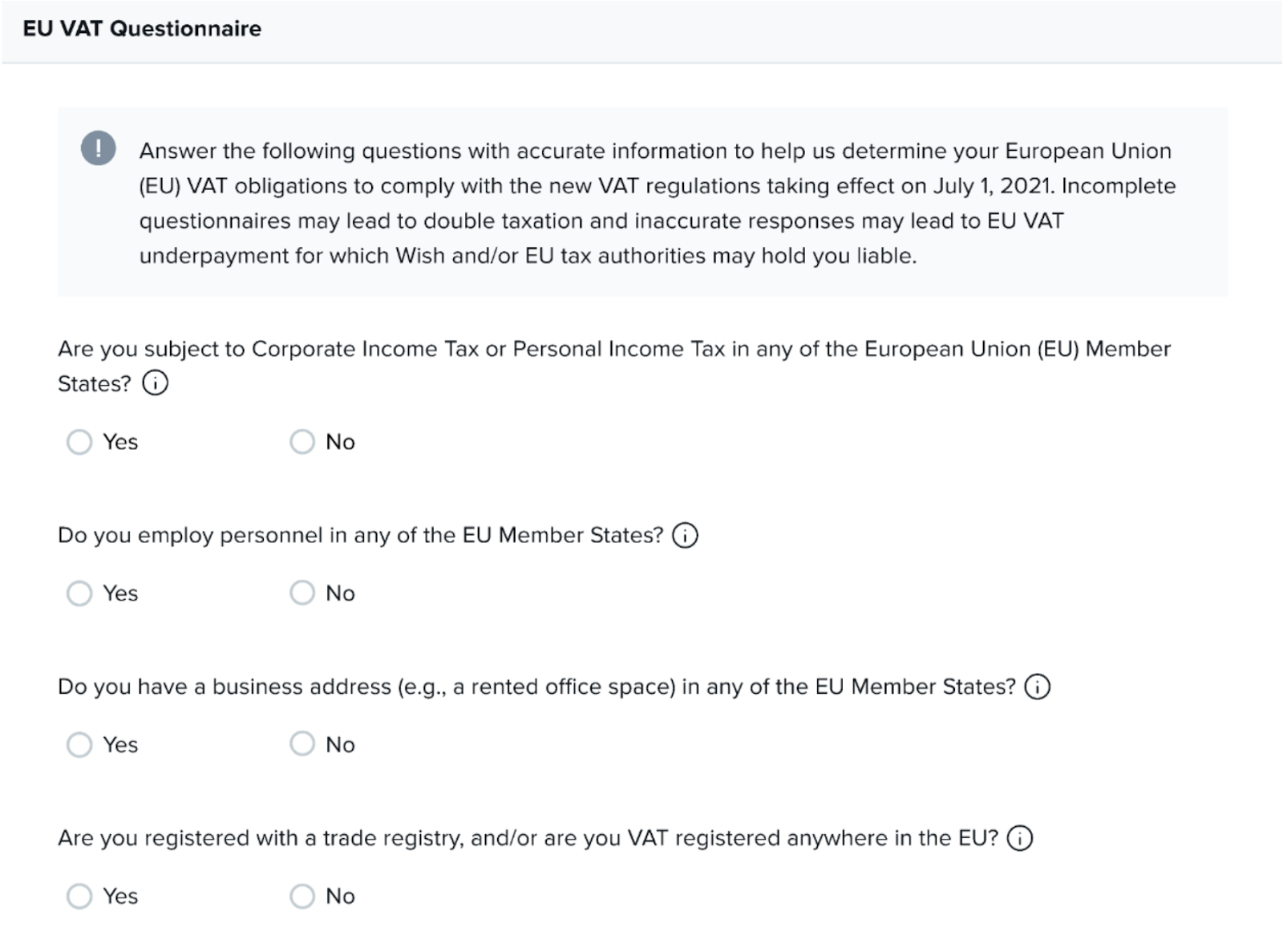

2. 在“欧盟增值税问卷”页面,准确回答所有问题,帮助 Wish 确定商户的欧盟增值税义务。

1). 您是否在任意欧盟成员国负有企业所得税或个人所得税纳税义务?

如果回答“是”,商户必须上传公司营业执照作为证明。如需了解如何获得公司营业执照副本,请与注册国家/地区的企业注册机构联系或访问其网站。

如果回答“否”,商户需继续回答问题2、问题3和问题4。

2). 您是否在任意欧盟成员国雇用了员工?

3). 您是否在任意欧盟成员国有办公地址(如租用的办公室)?

如果回答“是”,商户必须提供办公地址。如果商户在欧盟境内有多个办公地址,只需提供一个。

4). 您是否在任意欧盟成员国的商业登记处进行了登记,并且/或者注册了增值税号码?

如果回答“是”,商户必须提供增值税号码和/或商业登记号。为了帮助 Wish 验证信息,我们强烈建议商户尽可能两个号码都提供。请注意,在“增值税号码”字段输入值后,“增值税登记国家/地区”下拉菜单将变成必填项。

回答完所有相关问题后,点击“提交”,将问卷提交给 Wish 进行审核。

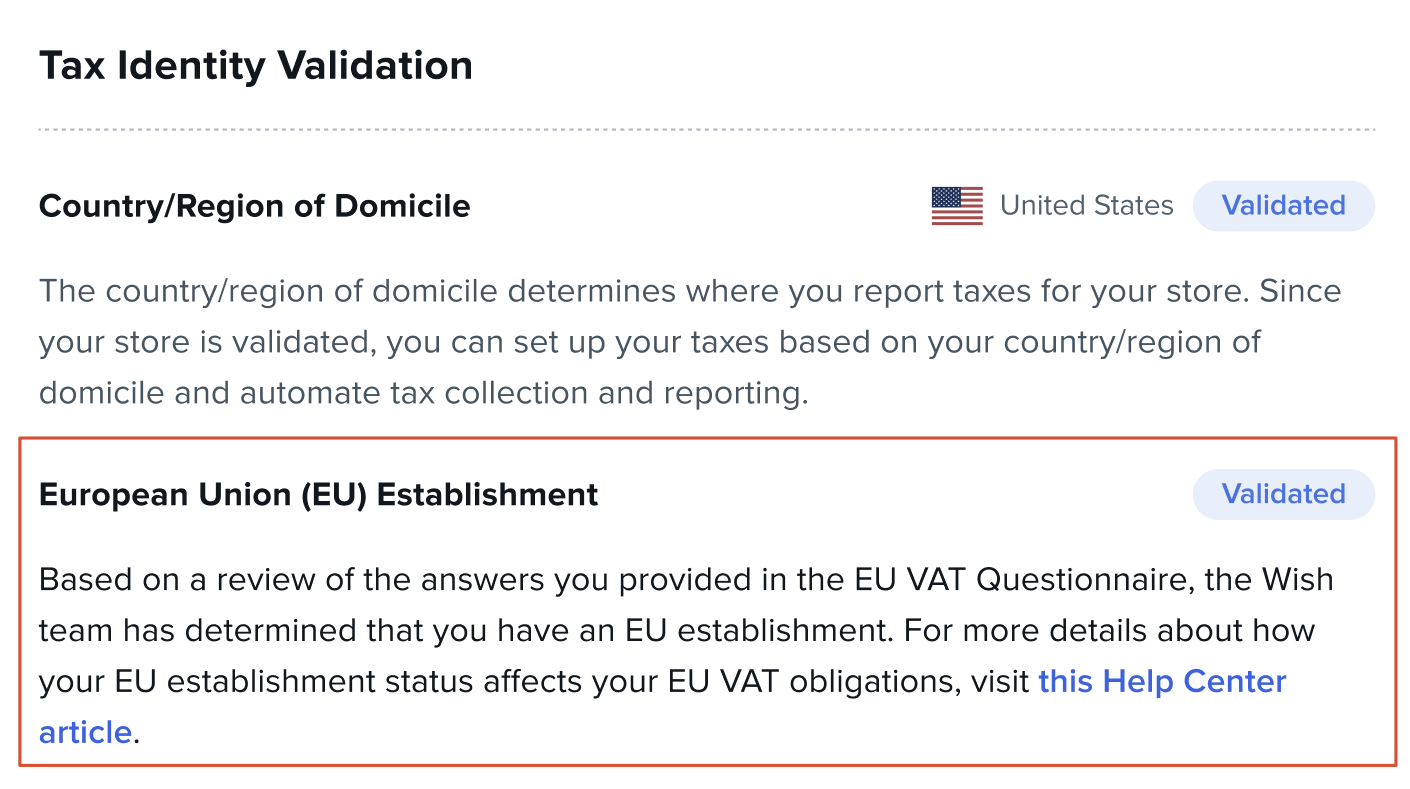

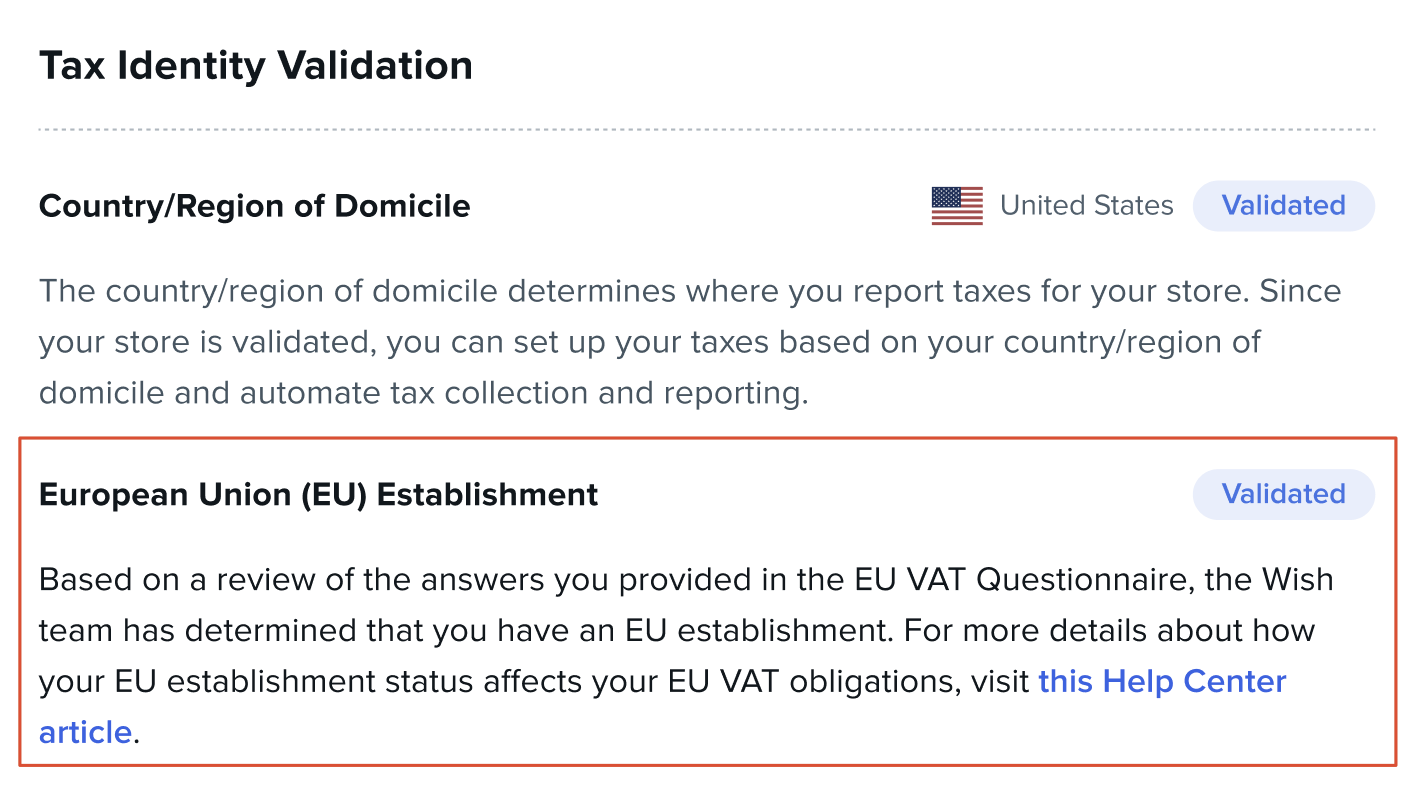

3. 审核完成后,商户可在税务设置页面看到其店铺的“欧盟营业机构”状态,根据商户对问卷的回答,可能有以下几种状态:

未设立:欧盟增值税问卷已成功提交,Wish 已确定商户没有在欧盟境内设立营业机构。如果商户认为在问卷中提供的信息不准确,可在“欧盟营业机构”状态区域点击“重新提交问卷”按钮,重新填写后再提交。

待审核:欧盟增值税问卷已成功提交,Wish 团队正在进行审核。在最终确定“欧盟营业机构”状态之前,Wish 将假设商户尚未在欧盟境内设立营业机构。

已验证:根据商户在欧盟增值税问卷中提供的信息,经审核,Wish 团队已确定商户在欧盟境内设有营业机构。

已拒绝:根据商户在欧盟增值税问卷中提供的信息,经审核,Wish 团队已拒绝商户的提交,并确定商户没有在欧盟境内设有营业机构。如果商户认为在问卷中提供的信息不准确,可在“欧盟机构”状态区域点击“重新提交问卷”按钮,重新填写后再提交。

请注意,如果商户不小心错过或跳过商户平台主页“待办项”部分的提示,也可以直接从税务设置页面访问问卷。在完成问卷之前,上面显示的“欧盟营业机构”状态将为未开始。

接下来,欧盟本土商户以及在欧盟境内设有营业机构的非欧盟本土商户(根据上述问卷确定)可以参阅此指南,完成欧盟“税务设置”(2021年6月28日起开始可以设置)。

注意:拥有 Merchant Plus 平台访问权限的商户可直接通过 https://merchant.wish.com/tax/settings 访问欧盟增值税问卷。Merchant Plus 商户还会收到完成问卷的电子邮件通知。

wish商户官网原文详情:

See below for a walkthrough of how to complete the EU VAT Questionnaire on Merchant Dashboard (for details on how to access the questionnaire via Merchant Plus dashboard, see the end of this article):

1. For non-EU domiciled merchants who have already enabled shipping to some or all EU countries in Account > Shipping Settings, the EU VAT Questionnaire can be accessed under the “Things to do” section of the Merchant Dashboard homepage by clicking “Start Questionnaire”. Applicable merchants will also be notified by email to complete this questionnaire.

Additionally, any non-EU domiciled merchant attempting to enable an EU destination country in Account > Shipping Settings will be prompted to complete the questionnaire after clicking “Apply to existing non-promoted products”. Please note that going forward, merchants will not be allowed to enable new EU countries in Shipping Settings until the questionnaire has been completed.

2. On the EU VAT Questionnaire page, answer the questions accurately to help Wish determine merchants’ EU VAT obligations.

1). Are you subject to Corporate Income Tax or Personal Income Tax in any of the European Union (EU) Member States?

If Yes, merchants will be required to upload their business registration extract document as proof. Merchants may find out how to request a copy of this document by contacting or visiting the website of their national or local company register.

If No, merchants will be prompted with questions 2, 3, and 4.

2). Do you employ personnel in any of the EU Member States?

3). Do you have a business address (e.g. a rented office space) in any of the EU Member States?

If Yes, merchants will need to provide their business address. If merchants have multiple business addresses in EU countries, they will only need to provide one business address.

4). Are you registered with a trade registry, and/or are you VAT registered in any of the EU Member States?

If Yes, merchants will need to provide your VAT Number and/or Business Registration Number. To help with the information validation process, we strongly encourage merchants to provide both numbers if possible. Please note that entering any value in the VAT Number field will make the Country/Region for VAT Registration dropdown required to complete.

Click “Submit” after answering all applicable questions to submit the questionnaire to Wish for review.

3. See below for a breakdown of various EU Establishment statuses (seen on the Tax Settings page) based on answers to the questionnaire:

Not Established: EU VAT Questionnaire has been successfully submitted and it has been determined that the merchant does not have an EU establishment. If the merchant believes that inaccurate information has been provided in the questionnaire, they may click the “Re-submit Questionnaire” button under the EU Establishment status area to access it again and re-submit.

Pending Review: EU VAT Questionnaire has been successfully submitted and is currently being reviewed by the Wish team. Until the EU establishment status is finalized, Wish will assume that the merchant does not have an EU establishment yet.

Validated: Based on a review of the answers provided in the EU VAT Questionnaire, the Wish team has determined that the merchant has an EU establishment.

Rejected: Based on a review of the answers provided in the EU VAT Questionnaire, the Wish team has rejected the merchant’s submission and determined that the merchant does not have an EU establishment. If the merchant believes that inaccurate information has been provided in the questionnaire, they may click the “Re-submit Questionnaire” button under the EU Establishment status area to access it again and re-submit.

Note that if merchants accidentally missed or skipped the prompt from the “Things to do” section on Merchant Dashboard homepage to access the questionnaire page, they may also access the questionnaire directly from Tax Settings homepage. Until the questionnaire is completed, the status of “European Union (EU) Establishment” shown above will be Not Started.

Next, EU domiciled merchants and non-EU domiciled merchants with an EU establishment (as determined by the above questionnaire) can use this guide to set up their EU Tax Settings (available to set up starting June 28, 2021).

NOTE: Merchants with access to Merchant Plus dashboard may access the EU VAT Questionnaire by visiting https://merchant.wish.com/tax/settings directly. Merchant Plus merchants will also be prompted to complete the questionnaire via email.

文章内容来源:wish商户官方网站